MBA NewsLink interviewed Keith Banhazl, Victor Calanog and Nick Levidy from Moody’s, New York.

Category: News and Trends

MBA Seeks Collaboration with CSBS on Remote Work Flexibility for State Licensees

The Mortgage Bankers Association asked the Conference of State Bank Supervisors to collaborate in addressing the real estate finance industry’s near-term issues related to work-from-home orders, and to build a longer-term framework for remote work capabilities to address future health emergencies, natural disasters and changing attitudes toward telework in today’s economy.

Fitch: Borrowers Skipping Payments on Home Loans More Often Than Other Debt

Residential mortgage borrowers are missing more payments and taking advantage of payment holiday programs at a higher rate than comparable-credit borrowers of auto loans and credit cards, said Fitch Ratings New York.

The 2020 Census: Easy, Safe and Important

Counting everyone who lives in the United States, the 2020 Census is happening now with 92.2 million households or more than 62 percent of the country having already responded. But the 2020 Census is not finished. The Census Bureau is done when the country achieves a complete and accurate count.

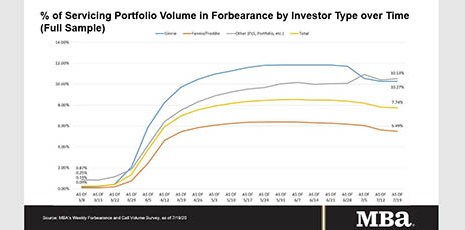

MBA: Share of Loans in Forbearance Falls for 6th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 6 basis points to 7.74% of servicers’ volume as of July 19, from 7.80% the prior week. MBA now estimates 3.9 million homeowners are in forbearance plans.

Quote

“The share of loans in forbearance declined by a smaller amount than in previous weeks, as the pace of borrowers exiting forbearance slowed. Although the GSE portfolio of loans in forbearance should continue to improve, Ginnie Mae’s portfolio saw an uptick of both loans in forbearance and borrowers requesting forbearance. The high level of unemployment claims in recent weeks may be playing a role, as weakness would likely impact Ginnie Mae’s portfolio first.”

–MBA Chief Economist Mike Fratantoni.

Quote

“The share of loans in forbearance declined by a smaller amount than in previous weeks, as the pace of borrowers exiting forbearance slowed. Although the GSE portfolio of loans in forbearance should continue to improve, Ginnie Mae’s portfolio saw an uptick of both loans in forbearance and borrowers requesting forbearance. The high level of unemployment claims in recent weeks may be playing a role, as weakness would likely impact Ginnie Mae’s portfolio first.”

–MBA Chief Economist Mike Fratantoni.

MISMO Releases Proposed Commercial Appraisal Data Standards

MISMO®, the mortgage industry standards organization, released new proposed data standards for commercial property appraisals. The new dataset will facilitate efficient exchange of appraisal information across the commercial real estate finance industry.

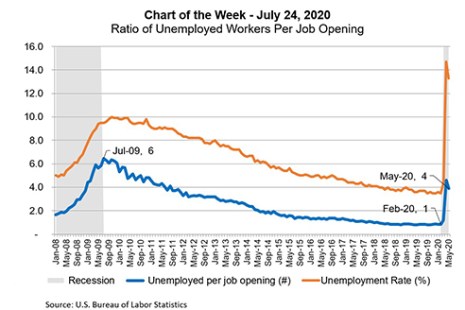

MBA Chart of the Week: Ratio of Unemployed Workers Per Job Opening

This week’s MBA Chart of the Week uses data from the U.S. Bureau of Labor Statistics to look at the ratio of the number of unemployed workers to job openings to highlight how the current recession is different than the recession in 2007-2009.

Chris Lewis: 3 Steps You Should Take Now to Get Ready for RON

Many of the industry’s efficiency experts have long argued that a digital mortgage can save all parties time and money. In the past, however, there were too many downstream issues that blocked the process from full-scale adoption. But with shelter in place, safer at home and social distancing all coming into play, the pandemic has led to a renewed push to get a completely digital mortgage as the new way to close all your loans.