As COVID-19 continues to affect the mortgage industry, lenders are realizing that conducting business as usual may not be possible or plausible. For a lender’s growth to reach new and different heights in 2020, new and different business practices, such as working with a hedge advisory firm, are required.

Category: News and Trends

Dealmaker: Hunt Real Estate Capital Provides $37M in Fannie Mae, Freddie Mac Funds

Hunt Real Estate Capital, New York, provided $37.2 million in Fannie Mae and Freddie Mac funds for Texas and Minnesota multifamily properties.

Momentum Builds as 2nd FHLB Accepts eNotes

Earlier this month, the Federal Home Loan Bank of Des Moines became the first of the 11-member FHLB system to announce it would accept residential mortgage electronic promissory notes—eNotes—as collateral. Now, a second FHLB has jumped on the eNotes bandwagon.

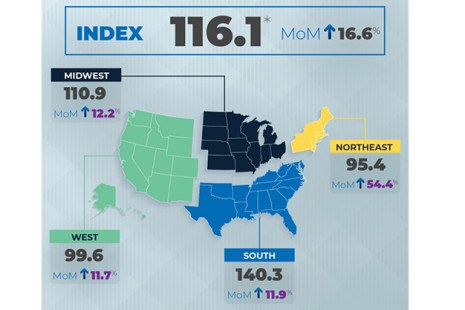

Pending Home Sales Jump Nearly 17%

Pending home sales jumped for the second straight month in June, the National Association of Realtors reported yesterday.

MBA Education Path to Diversity Scholar Profile: Christa Thomas

(One of a continuing series of profiles of participants in the MBA Education Path to Diversity (P2D) Scholarship Program, which enables employees from diverse backgrounds to advance their professional growth and career development.)

Quote

“Conditions have changed with the onset of the COVID-19 pandemic, the greatest being increased uncertainty. Interest rates are now lower than they were a year ago, and data have yet to show any marked changes in property incomes or values. Demand for refinancing because of low rates, particularly for government-backed loans, is unlikely to overcome a drop in sales transactions, which means multifamily borrowing and lending is likely to drop this year.”

–MBA Vice President of Commercial Real Estate Research Jamie Woodwell.

Mortgage Applications Decrease in MBA Weekly Survey

Mortgage applications fell for the first time in four weeks, albeit slightly, as the 30-year fixed rate held at a record low, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending July 24.

The CMBS Market During the Pandemic: A Conversation with Moody’s Investors Service

MBA NewsLink interviewed Keith Banhazl, Victor Calanog and Nick Levidy from Moody’s, New York.

Fannie Mae: Helpful eMortgage Resources

With the recent shift many people have experienced to remote work, digital closing options are top of mind for lenders. Fannie Mae has a variety of eMortgage resources to help you.

Kelly Hebert: Avoid the Chaos, Communicate Clearly

Communication is the backbone of our business and personal lives. And if we can understand the power of positive communication a little better, and work to harness the power that communication can provide, we can all be a little more productive, more informed and more successful in achieving our goals.