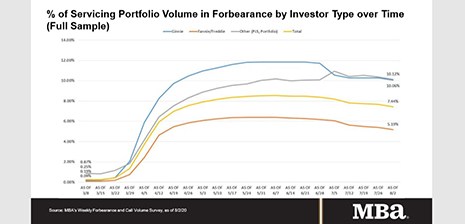

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 23 basis points to 7.44% of mortgage servicers’ portfolio volume as of Aug. 2, down from 7.67% of servicers’ portfolio volume the prior week. MBA estimates 3.7 million homeowners are in forbearance plans.

Category: News and Trends

People in the News–Aug. 12, 2020

Brookstone Management, Howell, N.J., a national provider of mortgage field services, announced JK Huey, CMB, AMP, joined its Advisory Board and will serve as Corporate Ambassador.

Brian Zitin: Appraisals—The Final Frontier in Digital Mortgage

With the average time to close a mortgage transaction still 40+ days, the experience of a “one-tap” digital mortgage seems distant to most onlookers. In reality, however, the important measure of efficiency is how long a borrower actually spends in the mortgage factory line—in other words, how long it takes to get approved and complete all of the necessary requirements and paperwork before closing.

MBA Education Path to Diversity Scholar Profile: Jeannie Sosebee, AMP

(One of a continuing series of profiles of participants in the MBA Education Path to Diversity (P2D) Scholarship Program, which enables employees from diverse backgrounds to advance their professional growth and career development.)

Call For Proposals: MBA Live Accounting and Financial Management; Deadline Aug. 13

The MBA Accounting & Financial Management Conference will be held virtually, December 9 – 10. Speaking proposals are being accepted until Thursday, August 13.

MBA Asks CFPB to Extend GSE ‘Patch’ Sunset

The Mortgage Bankers Association, in a comment letter yesterday to the Consumer Financial Protection Bureau, asked the Bureau to extend the temporary GSE Qualified Mortgage loan definition, also known as the GSE “Patch,” for an additional six months following the effective date for the revised general QM parameters.

MBA, Trade Groups Ask CFPB to Extend Comment Period on ECOA Request for Information

The Mortgage Bankers Association and nearly a dozen industry trade organizations yesterday asked the Consumer Financial Protection Bureau to extend the comment period on its Request for Information on expanding access to credit through Regulation B, which implements the Equal Credit Opportunity Act.

MBA Asks CFPB to Extend GSE ‘Patch’ Sunset

The Mortgage Bankers Association, in a comment letter yesterday to the Consumer Financial Protection Bureau, asked the Bureau to extend the temporary GSE Qualified Mortgage loan definition, also known as the GSE “Patch,” for an additional six months following the effective date for the revised general QM parameters.

CRE Lending Eases as Underwriting Turns Conservative

CBRE, Los Angeles, said a temporary freeze in commercial real estate lending and transaction markets beginning in mid-March through early April led to fewer loan closings in the second quarter.

MBA: Share of Mortgage Loans in Forbearance Decreases for 8th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 23 basis points to 7.44% of mortgage servicers’ portfolio volume as of Aug. 2, down from 7.67% of servicers’ portfolio volume the prior week. MBA estimates 3.7 million homeowners are in forbearance plans.