After a strong start to 2020, COVID-19’s impacts on North American commercial real estate hit during the second quarter, reported Transwestern, Houston, and Devencore, Toronto.

Category: News and Trends

MBA, Trade Groups Issue Joint Statement on GSE Adverse Market Fee

The Mortgage Bankers Association yesterday joined a broad coalition of organizations representing the housing, financial services industries as well as public interest groups issued the following statement on the GSEs’ new adverse market fee.

MBA Education TRID Implications of GSE Loan Level Price Adjustment Announcement Webinar Today

Join MBA policy staff and industry experts this afternoon for a critical discussion on the impact of Wednesday’s GSE announcement on TRID disclosures. While this topic will continue to evolve in the coming days, attendees can expect to learn about the immediate concerns and questions that will most likely impact your business and processes.

Quote

“Requiring Fannie Mae and Freddie Mac to charge a 0.5% fee on refinance mortgages they purchase will raise interest rates on families trying to make ends meet in these challenging times. This means the average consumer will be paying $1,400 more than they otherwise would have paid. Even worse, the September 1 effective date means that thousands of borrowers who did not lock in their rates could face unanticipated cost increases just days from closing.”

–MBA Senior Vice President of Legislative and Political Affairs Bill Killmer.

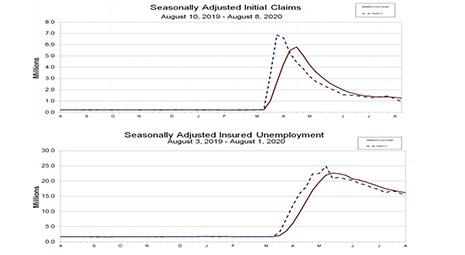

Initial Claims Fall Under 1 Million, Remain Historically Elevated

For the first time since the economic effects of the coronavirus took hold, new applications for unemployment fell below one million, although they remain elevated by historic standards.

MBA Mortgage Action Alliance ‘Call to Action’ Targets GSE Refi Fee

In the wake of new directive by Fannie Mae and Freddie Mac to impose a 50 basis point “Adverse Market Refinance Fee” on most refinance mortgages, effective Sept. 1, the Mortgage Bankers Association’s grassroots advocacy arm, the Mortgage Action Alliance, issued a ‘Call to Action’ urging its 50,000 members to contact their members of Congress and the Federal Housing Finance Agency to roll back the directive.

Analysts Downgrade Hotel Outlook

Full recovery in U.S. hotel demand and room revenue remains unlikely until 2023 and 2024, respectively, said STR, Hendersonville, Tenn., and Tourism Economics, Wayne, Pa.

Distressed Debt Monitor: A Conversation with Mayer Brown Partner Jeffrey O’Neale

MBA NewsLink interviewed Jeffrey O’Neale, a partner in Mayer Brown’s Charlotte office and a member of the Real Estate Markets practice. A primary focus of his practice is representing special servicers in loan workouts, restructurings and modifications and repurchase facility buyers in the servicing and administration of their commercial mortgage loan portfolios.

Dealmaker: Greystone Provides $100M in HUD-Insured Multifamily Financing

Greystone, New York, provided $100.3 million in HUD-insured loans for multifamily properties in California and Texas.

Mark Dangelo: Beyond Digital Transformation—A Tale of What is Coming

The leverage of all things digital is here. However, digitalization is NOT digital transformation, let alone digital leverage. As finance firms and their target markets reach their cycle peaks, the leverage of digital is a requirement most banking leaders have not incorporated into their forthcoming budgets and operations.