Pending home sales marked three consecutive months of growth in July, the National Association of Realtors reported yesterday, with all four major regions reporting gains in both month-over-month and year-over-year transactions.

Category: News and Trends

More Space, Please: Sales of Large Homes Up 21%

The typical home that sold in the four weeks ending August 16 was 3.7% larger (1,772 square feet) than sold a year earlier, when it was just 0.4% larger, said Redfin, Seattle.

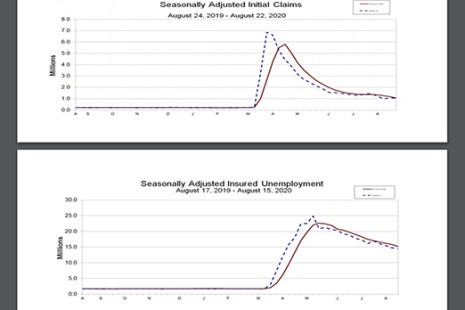

Initial Claims Dip But Hold Above 1 Million

Initial unemployment claims for the week ending Aug. 22 fell slightly from last week but remained above one million, as the economic recovery from the coronavirus pandemic continues to prove difficult.

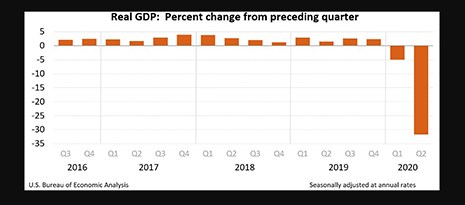

Revised 2nd Quarter GDP No Real Improvement

After a stunning 32.9 percent plunge in 2nd quarter gross domestic product, analysts hoped yesterday’s revised numbers would paint a more optimistic picture. It didn’t.

Freddie Mac: More High-Income Households Renting, But Low-Income Renters Face Limited Options

Fewer than 10 percent of rental units are currently affordable to renter households earning 50 percent of median renter income, reported Freddie Mac, McLean, Va.

GSEs, FHA Extend Foreclosure/REO Eviction Moratoria

The government-sponsored enterprises and HUD yesterday announced they would extend foreclosure moratoria to all GSE-backed mortgages and FHA-backed mortgages, respectively and extend eviction moratoria through at least Dec. 31.

Dealmaker: Largo Group Secures $43M

The Largo Group of Cos., Getzville, N.Y., secured $43.2 million in financing for multifamily, industrial, office and mixed-use properties in New York, Idaho and Ontario, Canada.

FHFA Extends GSE Forbearance Purchases through Sept. 30; Extends COVID-Related Loan Processing Flexibilities

The Federal Housing Finance Agency announced Wednesday that Fannie Mae and Freddie Mac will extend buying qualified loans in forbearance and several loan origination flexibilities through September 30.

Nate Johnson: 3 Ideas Toward a Fast, Efficient, Profitable Mortgage Operations Process

The U.S. real estate industry is in a volatile state – as much, if not more, than it was during the 2008 financial crisis. We are seeing some record numbers in the mortgage industry with rising foreclosures, really low interest rates, and shortage of inventory. This does seem to be a stable environment, though – but while things seem to fall in place at times, the next moment new factors disrupt the market environment. Here are three areas of turbulence in the mortgage industry.

MBA Education Path to Diversity Scholar Profile: Malik Wilkes

(One of a continuing series of profiles of participants in the MBA Education Path to Diversity (P2D) Scholarship Program, which enables employees from diverse backgrounds to advance their professional growth and career development.)