Institutional Property Advisors, Ontario, Calif., brokered the sale of North Lake Business Park in Altamonte Springs, Fla., for $28.5 million.

Category: News and Trends

CRE Prices Slip, Sales Volume Tumbles

Commercial real estate asset prices dipped in July while sales volume fell significantly, said Real Capital Analytics and CoStar Group.

Regrets? For Some Homeowners During Pandemic, a Few

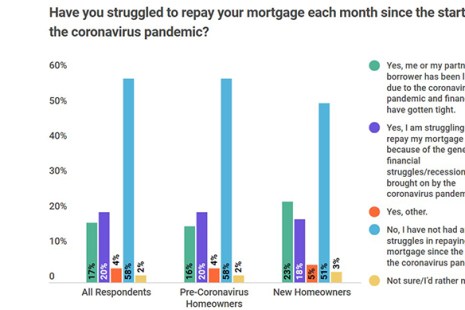

A new survey from LendEDU, Hoboken, N.J., finds more than half of new homeowners regret taking out a mortgage during the coronavirus pandemic, with most of them citing a job layoff as the reason for their angst.

ADP: August Employment Up by 428,000

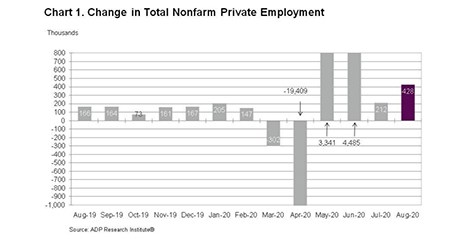

Ahead of this morning’s unemployment insurance claims report from the Labor Department and Friday’s employment report from the Bureau of Labor Statistics, ADP, Roseland, N.J., said private-sector employment increased by 428,000 jobs in August.

Industry Briefs Sept. 3, 2020

CoreLogic, Irvine, Calif., issued a new data analysis estimating insured wind and storm surge losses for residential and commercial properties in Louisiana and Texas at between $8 billion and $12 billion, with insured storm surge losses estimated to contribute less than $0.5 billion to this total.

MBA Education Path to Diversity Scholar Profile: Gabrielle Beck

(One of a continuing series of profiles of participants in the MBA Education Path to Diversity (P2D) Scholarship Program, which enables employees from diverse backgrounds to advance their professional growth and career development.)

Debora Aydelotte: Mortgage Professionals Need to Prepare for COVID’s Impact into 2021

With the onset of the COVID-19 pandemic in the U.S. in early March, the better portion of 2020 has been devoted to adjusting to the “new normal.” Although expectations are high that a vaccine will be readily available by the year’s end, the situation is complex and defies a neat solution. Therefore, as leaders we need to think about how to prepare for what 2021 might hold.

Quote

“We’re seeing a new wave of younger millennial home buyers flood the market as we enter peak homebuying season. With interest rates at historic lows, now is the perfect time for younger millennials to purchase a home and start building equity.”

–Ellie Mae Chief Operating Officer Joe Tyrrell.

Administration Issues Nationwide Eviction Moratorium Through Dec. 31

Citing the need to “prevent the further spread of COVID-19,” the Trump Administration on Sept. 1 issued an order temporarily halting residential evictions through Dec. 31.

Mortgage Applications Down for 3rd Straight Week in MBA Weekly Survey

Mortgage applications fell for the third straight week even as interest rates dipped again, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending August 28.