On Tuesday, SimpleNexus, Lehi, Utah, named Cathleen Schreiner Gates as its new President, responsible for all operations and business strategy. MBA NewsLink had the opportunity to talk with her about her new role and the state of the mortgage industry.

Category: News and Trends

Ground-Up Construction Roundup: A Conversation with Key Bank SVP David Drummond and Rabbet CEO Will Mitchell

MBA Newslink interviewed Key Bank Real Estate Capital Senior Vice President David Drummond and Rabbet Chief Executive Officer Will Mitchell about trends and developments in the commercial and multifamily construction sector.

In a Most Unusual Year, MBA Mortgage Action Alliance Shines

The Mortgage Action Alliance–MBA’s grassroots advocacy arm—has enjoyed unprecedented success and influence at a key time for the industry.

John Russo: How Loan Officers Can Underwrite Their Own Success

Whether relatively new to the industry or a seasoned mortgage professional, there are some key aspects today’s LOs must consider when searching for a new workplace. In many ways, it is to their benefit to approach it as they would a new potential borrower, as if they were underwriting the company.

Quote

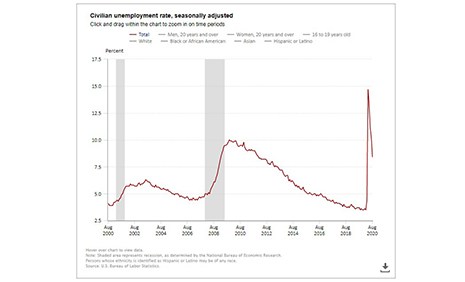

“The labor market continued to heal in August, with strong job growth and a large decline in the unemployment rate. However, the economy still faces an uphill climb and remains far away from full employment. High unemployment and jobless claims, consistently around 1 million a week, continue to cause financial strain for some borrowers–and especially for those who work in industries hardest hit by the pandemic.” –MBA Senior Vice President and Chief Economist Mike Fratantoni.

Employment Report: Progress, ‘But a Long Way to Go’

Total nonfarm payroll employment rose by 1.4 million in August, while the unemployment rate fell to 8.4 percent, the U.S. Bureau of Labor Statistics reported Friday.

MBA Advocacy Update Sept. 8, 2020

Last week, the White House announced that the Department of Health and Human Services and the Centers for Disease Control and Prevention declared a health emergency due to COVID-19, requiring a halt to evictions for renters through December 31.

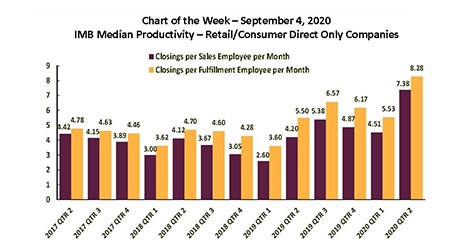

MBA Chart of the Week: Independent Mortgage Bank Median Productivity

MBA last week released its latest Quarterly Performance Report for the second quarter. The report showed a record-high average for net production profit of 167 bps ($4,548 per loan), as well as record-high average origination volume of $1.02 billion per company.

MBA Education Path to Diversity Scholar Profile: Austin Miller

(One of a continuing series of profiles of participants in the MBA Education Path to Diversity (P2D) Scholarship Program, which enables employees from diverse backgrounds to advance their professional growth and career development.)

John Seroka: 6 Marketing Best Practices to Ensure Continued Business Growth During and Post-Pandemic

During COVID, you must ensure you are communicating clearly about your business and any changes that may be taking place in terms of how you are operating and the resulting impacts on applicants and borrowers.