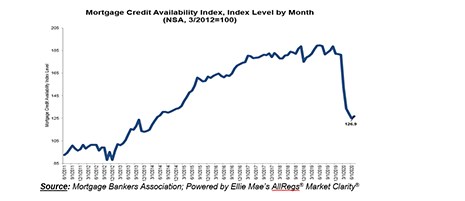

Mortgage credit availability decreased in August according to the Mortgage Credit Availability Index, a Mortgage Bankers Association report that analyzes data from Ellie Mae’s AllRegs® Market Clarity® business information tool.

Category: News and Trends

Industry Briefs Sept. 10, 2020

Intercontinental Exchange, Atlanta, received regulatory approval and completed its $11 billion acquisition of Ellie Mae from private equity firm Thoma Bravo.

Most Consumers Plan to Maintain Increased Digital Banking after Pandemic

COVID-19 has permanently changed how consumers interact with their financial services organization, reported BAI, Chicago.

MBA Education Path to Diversity Scholar Profile: Adam Krings

(One of a continuing series of profiles of participants in the MBA Education Path to Diversity (P2D) Scholarship Program, which enables employees from diverse backgrounds to advance their professional growth and career development.)

Remote Work Could Open Homeownership to Nearly Two Million New Households

The rise of remote work could unlock homeownership for nearly two million renter households, according to Zillow, Seattle.

Dealmaker: Walker & Dunlop Arranges $67 Million Construction Loan

Walker & Dunlop, Bethesda, Md., structured $67.2 million in financing to construct Shoma Village Apartments, a Class A mixed-use property with 304 apartment units and 11,625 square feet of retail in Hialeah, Fla.

CREW Network: CRE Industry Must Take Action for Gender Parity, Greater Diversity

Efforts to achieve gender parity in commercial real estate are far from complete–in fact, little progress has been made in the last five years, reported CREW Network, Lawrence, Kan.

MBA Responds to CFPB’s Proposed Rule Revising the General Qualified Mortgage Definition

On Tuesday, the Mortgage Bankers Association commented on the Consumer Financial Protection Bureau’s proposed rule to amend its General Qualified Mortgage (QM) loan definition in Regulation Z.

Multifamily Market Musings by Sharon Walker

The multifamily market continues evolving in 2020 with plenty of interesting developments across the sources of capital that lend to multifamily property owners.

Quote

“MBA commends the Bureau for this proposal and its commitment to ensure the continued availability of sustainable, affordable mortgage credit, while maintaining robust standards for high-quality QMs.”

–Mortgage Bankers Association President and CEO Robert Broeksmit, CMB in a letter to the Consumer Financial Protection Bureau.