(One of a continuing series of profiles of participants in the MBA Education Path to Diversity (P2D) Scholarship Program, which enables employees from diverse backgrounds to advance their professional growth and career development.)

Category: News and Trends

eMortgage Interest Accelerates During Pandemic

The coronavirus pandemic has increased market interest in eMortgages, reported Fitch Ratings, New York.

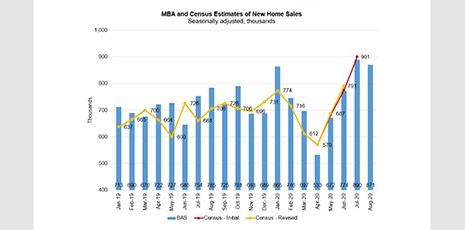

MBA August New Home Purchase Apps Down 4% from July, Up 33% From Year Ago

August mortgage applications for new home purchases increased by 33.3 percent from a year ago but fell by 4 percent from July, the Mortgage Bankers Association reported this morning.

Dealmaker: M&T Realty Capital Corp. Provides $124M for Multifamily

M&T Realty Capital Corp., Baltimore, closed $123.9 million in Fannie Mae and Freddie Mac multifamily loans.

Housing Report Roundup: Refi Candidates at Record High; Lenders’ Profit Outlook Improves; Homebuyers Undeterred by High Prices

Here’s a roundup of recent housing finance market reports, from Black Knight, Fannie Mae and Redfin.

CoreLogic: Single-Family Rents Stabilize

CoreLogic, Irvine, Calif., said single-family rent growth stabilized in July after seeing its slowest growth in a decade during June.

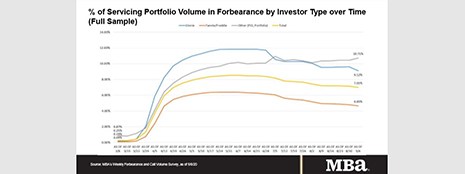

MBA: Share of Mortgage Loans in Forbearance Declines to 7.01%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 15 basis points last week to 7.01% of mortgage servicers’ portfolio volume as of Sept. 6, down from 7.16% the previous week. According to MBA estimates 3.5 million homeowners are in forbearance plans.

Quote

“With just under 1 million unemployment insurance claims still being filed every week, the lack of additional fiscal support for the unemployed could lead to even higher increases of those needing forbearance.”

–MBA Chief Economist Mike Fratantoni.

MBA: Share of Mortgage Loans in Forbearance Declines to 7.01%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 15 basis points last week to 7.01% of mortgage servicers’ portfolio volume as of Sept. 6, down from 7.16% the previous week. According to MBA estimates 3.5 million homeowners are in forbearance plans.

Quote

“With just under 1 million unemployment insurance claims still being filed every week, the lack of additional fiscal support for the unemployed could lead to even higher increases of those needing forbearance.”

–MBA Chief Economist Mike Fratantoni.