MBA is gearing up for its first-ever virtual Annual Convention & Expo. Taking place October 19-21 via MBA LIVE, attendees can connect whenever they want, from wherever they want.

Category: News and Trends

Fraud Update – 2020 and Beyond (MBA LIVE)

The recent—and fast—switch to digital mortgage, remote online notarization and closings have opened the door for new fraud activity.

Quote

“Virtually every loan is riskier than it was when we began this year, and as a consequence virtually all companies have modified their manufacturing process to identify and mitigate those additional risk.”

–MBA Chair-Elect Susan Stewart, opening the MBA Risk Management, Quality Assurance & Fraud Prevention Forum yesterday.

Susan Stewart: COVID-19 Puts Risk Management, QA, Fraud Prevention ‘Front and Center’ (MBA LIVE)

Mortgage Bankers Association Chair-Elect Susan Stewart kicked off the MBA Risk Management, Quality Assurance and Fraud Prevention Forum with an astute observation: the coronavirus pandemic has put such issues “front and center.”

MBA, Trade Groups Ask Congress to Continue Flood Insurance Program

With the National Flood Insurance Programs set to expire—yet again—the Mortgage Bankers Association and nearly two dozen industry trade groups asked Congress for another program extension as policymakers work on a longer-term solution.

Dealmaker: CBRE Closes $27M in Office Sales

CBRE brokered two southern California office building sales that totaling $26.75 million.

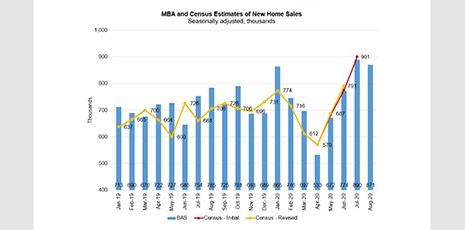

MBA: August New Home Purchase Apps Down 4% from July, Up 33% From Year Ago

August mortgage applications for new home purchases increased by 33.3 percent from a year ago but fell by 4 percent from July, the Mortgage Bankers Association reported this morning.

Fitch: eMortgage Interest Accelerates During Pandemic

The coronavirus pandemic has increased market interest in eMortgages, reported Fitch Ratings, New York.

People in the News Sept. 16, 2020

Roostify, San Francisco, named Chris Boyle President of Home Lending, responsible for all external-facing functions, client engagement, strategy, marketing and business development.

Beth Johnson: Unlocking the Numbers—Leveraging Granular Financial Detail in Business Strategy

In this industry, as part of the lender due diligence process, the financials and credit history of every mortgage banking customer are combed over and scrutinized. Mortgage banks search for any and every detail to properly assess the probability of loan repayment. However, when it comes to their own financials, not all lenders give as much consideration to the details as others.