RMQA panel story lede sentence HERE

Category: News and Trends

Fed Leaves Rates Alone; Ups Plans to Purchase Securities

The Federal Open Market Committee, as expected, left the federal funds rate untouched yesterday following its two-day policy meeting, and said it might stay that way until 2023.

Dealmaker: Marcus & Millichap Closes $109M in Multifamily Sales

Marcus & Millichap, Calabasas, Calif., brokered two multifamily asset sales totaling $109 million.

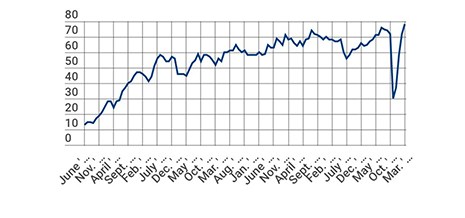

September Home Builder Confidence Hits Record High

After a steep drop in April at the onset of the coronavirus pandemic, builder confidence has soared to record highs, according to the National Association of Home Builders.

RIHA Study: COVID-19’s Impact on Jobs, Ability to Make Housing, Student Debt Payments

During the first three months of the COVID-19 pandemic, nearly 11 million households fell behind on their rent or mortgage payments and 30 million individuals missed at least one student loan payment, according to new research released today by the Mortgage Bankers Association’s Research Institute for Housing America.

Former Ambassador Andrew Young Keynotes MBA Annual20

Former Ambassador to the United Nations Andrew Young keynotes an important General Session at MBA Annual20, which runs online Oct. 19-21.

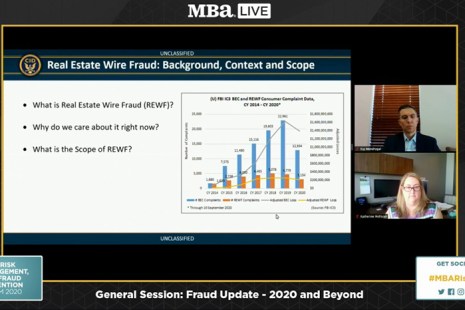

GSEs: Recession-Era QC Has Lenders Well-Prepared for Current Crisis (MBA LIVE)

Speaking virtually at the Mortgage Bankers Association’s Risk Management, Quality Assurance and Fraud Prevention Forum, GSE analysts said despite challenges resulting from increased volumes, economic instability and a sharp spike in unemployment–as well an abrupt shift to remote working–lenders have shown adaptability and a commitment to loan quality.

Genworth: ‘Sharp Slowdown’ in First-Time Homebuyer Market

The COVID-19 recession triggered a sharp slowdown in first-time homebuyer activity in the second quarter, reported Genworth Mortgage Insurance, Raleigh, N.C.

Mark Dangelo: Beyond Digital Transformation Part 2—Challenges of Digital Iterations

While advice and directions concentrate on the “next normal” inflicted by Covid-19, the underlying challenges facing financial services and banking organizations have been building long before its arrival. If banking and mortgage leadership are to adjust to an altered consumer and investment future, they must quickly determine how to build core competencies with digital leveraging—or risk becoming a statistic.

Quote

“From a QC standpoint, we’re dealing with opposite ends of the challenges. On one hand, we have record volume that everyone is struggling with, and an economy moving in the opposite direction, which has been a challenge for everyone in the industry to reconcile those differences.”

–Ronald Feigles, Vice President of Single-Family Quality Control and Fraud with Freddie Mac, McLean, Va.