“Continued churn in the job market is likely keeping many homeowners who have been in forbearance reluctant to exit, given the level of economic uncertainty.”

–MBA Chief Economist Mike Fratantoni.

“Continued churn in the job market is likely keeping many homeowners who have been in forbearance reluctant to exit, given the level of economic uncertainty.”

–MBA Chief Economist Mike Fratantoni.

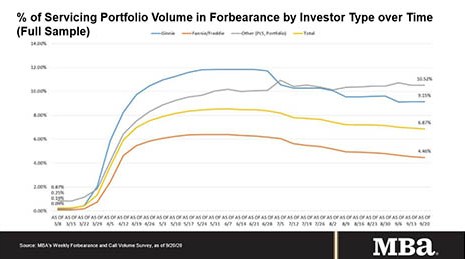

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 6 basis points to 6.87% of servicers’ portfolio volume as of September 20, from 6.93% the prior week. MBA estimates 3.4 million homeowners remain in forbearance plans.

“Continued churn in the job market is likely keeping many homeowners who have been in forbearance reluctant to exit, given the level of economic uncertainty.”

–MBA Chief Economist Mike Fratantoni.

Expert advice on maximizing current capacity, a winning market strategy, preparing your team for post-2020 success, and more.

Federal Reserve Chairman Jay Powell and Treasury Secretary Steven Mnuchin testified before House and Senate committees regarding the government’s response to the COVID-19 pandemic. On Tuesday, the Federal Housing Finance Agency published its strategic plan for the years 2021 through 2024, highlighting the agency’s ongoing efforts to reform the GSEs and improve its own internal operations.

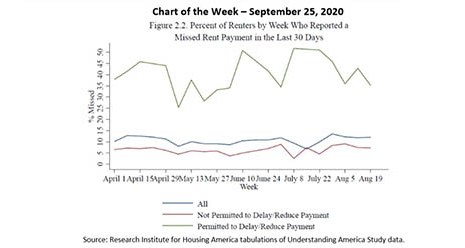

On September 17, the Research Institute for Housing America, MBA’s think tank, released a special report on housing-related financial distress during the second quarter – the first three months of the pandemic in the U.S.

Overlooking this factor when choosing an eClosing technology service provider could cost you.

Today’s financial services risk managers face two recurring issues. First, our work makes some people feel defensive; and second, we have to analyze complex business lines and correctly identify the right issues to focus upon.

(One of a continuing series of profiles of participants in the MBA Education Path to Diversity (P2D) Scholarship Program, which enables employees from diverse backgrounds to advance their professional growth and career development.)

The Mortgage Bankers Association is uniquely positioned to help our members and the commercial real estate finance industry address long-standing issues of social justice and inclusion as the premier trade association representing real estate finance.