We apparently haven’t seen a bottom in mortgage interest rates—and it got a lot of borrowers off their couches, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending October 2.

Category: News and Trends

Quote

“There are signs that demand is waning at the entry-level portion of the market because of supply and affordability hurdles, as well as the adverse economic impact the pandemic is having on hourly workers and low-and moderate-income households. As a result, the lower price tiers are seeing slower growth, which is contributing to the rising trend in average loan balances.”

–Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting.

Jessica Longman: Education is Key–Reduce Homeowner Frustration Regarding Property Taxes

Some of the most common questions that servicers receive from customers revolve around property taxes. An important aspect to providing an excellent experience for your customers includes educating them on the critical pieces they need to know about their loan; in turn this will reduce call volume relating to property tax questions and reduce overall homeowner frustration about taxes and payments.

Sponsored Content from ServiceLink: Keeping Up with Surging Demand Requires Smart Technology

With record-low interest rates and an ongoing rush of refinance demand, mortgage lenders are racing to process as much business as they can. How can their settlement service providers help?

MBA Offers FHFA Recommendations on GSE Strategic Plan

The Mortgage Bankers Association, in comments yesterday to the Federal Housing Finance Agency, said the FHFA Strategic Plan for fiscal years 2021-2024 should continue to work toward an ultimate goal: releasing Fannie Mae and Freddie Mac from federal conservatorship—but only when they are able to do so without risk to the real estate finance markets.

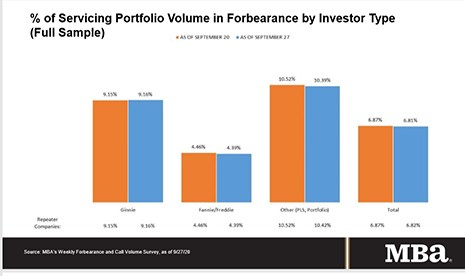

MBA: Share of Loans in Forbearance Falls to 6.81%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 6 basis points to 6.81% of servicers’ portfolio volume as of Sept. 27, from 6.87% the prior week. MBA now estimates 3.4 million homeowners are in forbearance plans.

Tom Millon, CMB, and Tony Pistilli: Valuations and the Pandemic–The ‘New Normal’ for Appraisal

Temporary, alternative inspections methods help to demonstrate the reliability and benefits of bifurcation and may very well assist in the evolution of home appraisals.

Along Came COVID: Emerging Tech Trends in Commercial Real Estate Finance

Emerging technologies and start-up firms proliferated in commercial real estate over the last several years. With the conventional wisdom being that while the single-family real estate finance industry has embraced new technologies and innovation, CRE was a laggard and therein lies a massive opportunity.

Former Ambassador Andrew Young Keynotes MBA Annual20; Early Registration Deadline Extended to Oct. 7

Former Ambassador to the United Nations Andrew Young keynotes an important General Session at MBA Annual20, which runs online Oct. 19-21.

MBA Offers FHFA Recommendations on GSE Strategic Plan

The Mortgage Bankers Association, in comments yesterday to the Federal Housing Finance Agency, said the FHFA Strategic Plan for fiscal years 2021-2024 should continue to work toward an ultimate goal: releasing Fannie Mae and Freddie Mac from federal conservatorship—but only when they are able to do so without risk to the real estate finance markets.