Office landlords are providing more concessions to their tenants under COVID-19, reported Trepp and CompStak.

Category: News and Trends

Ellie Mae: Low Interest Rates Spur Millennials to Action

Millennials continue to take advantage of record-low interest rates, according to Ellie Mae, Pleasanton, Calif.

Dealmaker: Meridian Capital Group Arranges $277M for Multifamily, Retail

Meridian Capital Group, New York, arranged $277.4 million to refinance three multifamily properties and a shopping center in New Jersey.

Julie Chipman: 5 Ways to Cultivate Culture while Onboarding Employees Remotely

When our entire workforce at Embrace Home Loans went remote in April, we faced the challenge of how to help make new employees feel welcome and part of the team. We’ve learned that managers are one of the most effective resources for building company culture. And this holds true not only for mortgage companies, but for most other industries as well.

mPower Event at MBA Annual20 with Capricia Marshall Oct. 20

The mPower event, Protocol: The Power of Diplomacy and How to Make it Work for You, takes place Tuesday, October 20 from 3:00-4:00 p.m. ET and features Capricia Marshall, who will share from her best-selling book of the same title and relate why protocol is important in everyone’s day to day lives.

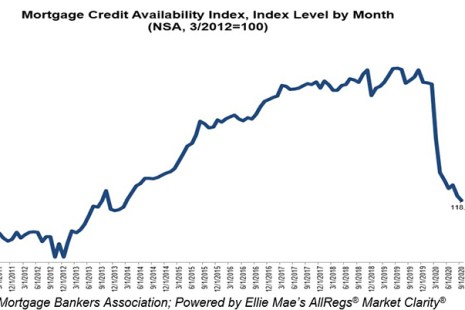

Mortgage Credit Availability Falls Again, Remains at 6-Year Low

Mortgage credit availability decreased in September, remaining at a six-year low, the Mortgage Bankers Association reported this morning.

Quote

“The housing market overall is on strong footing, but the data show that lenders are being cautious, given the spike in mortgage delinquency rates in the second quarter, as well as the ongoing economic uncertainty.”

–Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting.

Record-Low Interest Rates Spark Refi Surge in MBA Weekly Survey

We apparently haven’t seen a bottom in mortgage interest rates—and it got a lot of borrowers off their couches, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending October 2.

Placing Capital in Uncertain Times: A Conversation with CBRE’s Val Achtemeier

MBA NewsLink interviewed Valerie Achtemeier, Executive Vice President at CBRE Capital Markets in the Debt & Structured Finance Group. Based in Los Angeles, Achtemeier leads a team in placing debt and equity on commercial real estate throughout the U.S.

State Financial Regulators Seek Comment on ‘Prudential Standards’ for Nonbank Mortgage Servicers

The Conference of State Bank Supervisors seeks public input on proposed regulatory prudential standards for nonbank mortgage servicers, as the state-regulated industry covers an increasing share of this market.