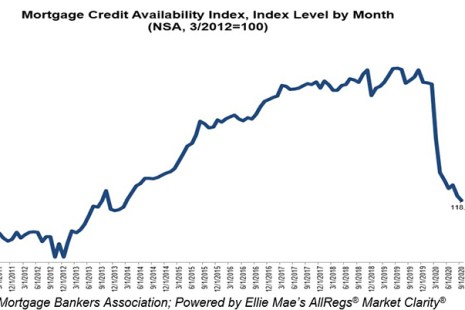

Mortgage credit availability decreased in September, remaining at a six-year low, the Mortgage Bankers Association reported this morning.

Category: News and Trends

Julie Chipman: 5 Ways to Cultivate Culture while Onboarding Employees Remotely

When our entire workforce at Embrace Home Loans went remote in April, we faced the challenge of how to help make new employees feel welcome and part of the team. We’ve learned that managers are one of the most effective resources for building company culture. And this holds true not only for mortgage companies, but for most other industries as well.

Along Came COVID: Emerging Tech Trends in Commercial Real Estate Finance

Emerging technologies and start-up firms proliferated in commercial real estate over the last several years. With the conventional wisdom being that while the single-family real estate finance industry has embraced new technologies and innovation, CRE was a laggard and therein lies a massive opportunity.

The World is Changing: is Real Estate Ready?

It’s safe to say 2020 has been one “hold my beer” moment after another. And the real estate finance industry, says States Title, San Francisco, had better be prepared for more changes—or risk obsolescence.

Sponsored Content from ServiceLink: Keeping Up with Surging Demand Requires Smart Technology

With record-low interest rates and an ongoing rush of refinance demand, mortgage lenders are racing to process as much business as they can. How can their settlement service providers help?

Placing Capital in Uncertain Times: A Conversation with CBRE’s Val Achtemeier

MBA NewsLink interviewed Valerie Achtemeier, Executive Vice President at CBRE Capital Markets in the Debt & Structured Finance Group. Based in Los Angeles, Achtemeier leads a team in placing debt and equity on commercial real estate throughout the U.S.

State Financial Regulators Seek Comment on ‘Prudential Standards’ for Nonbank Mortgage Servicers

The Conference of State Bank Supervisors seeks public input on proposed regulatory prudential standards for nonbank mortgage servicers, as the state-regulated industry covers an increasing share of this market.

CFPB Rescinds RESPA Section 8 Compliance Bulletin

In another victory for Mortgage Bankers Association advocacy, the Consumer Financial Protection Bureau yesterday rescinded a controversial Compliance Bulletin on prohibition of kickbacks and referral fees under the Real Estate Settlement Procedures Act.

ATTOM: Northeast Housing Markets at Highest Risk of Pandemic Economic Impact

ATTOM Data Solutions, Irvine, Calif., said its third-quarter Special Report shows pockets of the Northeast and Mid-Atlantic regions most at risk, with clusters in the New York City, Baltimore, Philadelphia and Washington, D.C. areas – while the West and now Midwest are less vulnerable.

The World is Changing: is Real Estate Ready?

It’s safe to say 2020 has been one “hold my beer” moment after another. And the real estate finance industry, says States Title, San Francisco, had better be prepared for more changes—or risk obsolescence.