MBA is pleased to announce that Federal Housing Finance Agency Director Mark Calabria and Consumer Financial Protection Bureau Director Kathy Kraninger will take the virtual stage at MBA Annual20. Calabria will deliver his remarks live on Monday, October 19 at 2:30 p.m. ET. On Tuesday, October 20 at 1:00 p.m. ET, hear a live interview with Kraninger, moderated by MBA 2021 Chairman Susan Stewart.

Category: News and Trends

Join the Radian Everyday Heroes Challenge, Benefiting the MBA Opens Doors Foundation

This year, as part of the MBA Annual Convention & Expo and ConcertMBA, Radian has launched the Radian Everyday Heroes Challenge, which celebrates the heroes among us who are making a positive impact, while also supporting the MBA Opens Doors Foundation.

What to Expect When Expecting Distress: A Servicer Roundtable

As COVID-19 and government responses continue to drive uncertainty around outcomes and outlooks, MBA Newslink interviewed senior professionals from a credit rating agency and several highly rated servicers to get their perspective on forbearance, loan workouts and portfolio management challenges for agency and non-agency CMBS.

MBA Advocacy Update Oct. 12, 2020

On Monday, MBA submitted comments to the Federal Housing Finance Agency in response to its Strategic Plan for Fiscal Years 2021-2024. The Strategic Plan includes several important reforms to the market conduct of the GSEs. And on Wednesday, the Consumer Financial Protection Bureau released new guidance on RESPA and marketing services agreements.

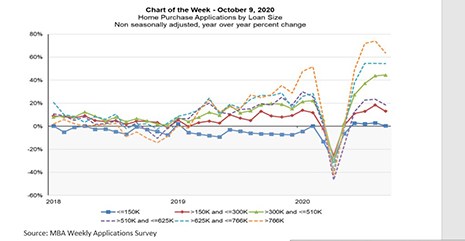

MBA Chart of the Week: Home Purchase Activity by Loan Size

This week’s MBA Chart of the Week highlights the year-over-year growth in purchase applications broken down by loan size tiers from 2018 to 2020.

MBA Premier Member Profile: Seyfarth Shaw LLP

With more than 900 lawyers across 17 offices, Seyfarth Shaw LLP provides transactional, advisory and litigation legal services to clients worldwide.

Sponsored Content from Nomis Solutions: What Are Mortgage Shoppers Looking for in 2020 and Beyond?

We focused on the importance of pricing along the customer journey: during the hunt for a loan, when comparing lenders before completing an application, and (given the ease of comparing prices online these days) whether consumers continue to shop once their application is underway. From this, we identified five insights that will guide lenders as they evolve and enhance their pricing capabilities.

Sponsored Content from Pavaso: Data Privacy and Working with eClosing Service Providers

With eClosings on the rise and remote online eClosings in demand during the COVID-19 pandemic, many lenders and settlement providers are eager to extend these services to their customers. There are many important factors to consider when selecting an eClosing technology service provider.

Lawson Hardwick: Maintaining Company Culture to Put Out Flames of Rapid-Fire Hiring

It is important to hire mindfully and focus on maintaining company culture during times of rapid expansion. Otherwise, it is easy to unknowlingly compromise culture. While drawing people in the door to help relieve the existing workload, some push through the hiring process too quickly and hire people who are not the right fit.

Julie Chipman: 5 Ways to Cultivate Culture while Onboarding Employees Remotely

When our entire workforce at Embrace Home Loans went remote in April, we faced the challenge of how to help make new employees feel welcome and part of the team. We’ve learned that managers are one of the most effective resources for building company culture. And this holds true not only for mortgage companies, but for most other industries as well.