Electra Capital, West Palm Beach, Fla., closed a $92 million bridge loan for Four West Las Olas, Elevate Partners’ new apartment tower in downtown Fort Lauderdale, Fla.

Category: News and Trends

MBA Urges FHFA to Extend Current GSE Affordable Housing Goals

The Mortgage Bankers Association, in a letter this morning to the Federal Housing Finance Agency, said FHFA should extend current affordable housing goals for Fannie Mae and Freddie Mac, given current economic uncertainty.

Apartment Leasing Rebounds in Third Quarter

Apartment leasing proved strong in the third quarter, bouncing back from the limited demand seen earlier this year, reported RealPage, Richardson, Texas.

Latinx Americans Driving U.S. Homeownership Gains, But Roadblocks Persist

“Remarkable growth” this past half-decade has boosted the share of Latinx households in the U.S. that own their home to its highest since the Great Recession, said Zillow, Seattle. However, despite these encouraging signs, roadblocks remain on the path to equitable housing.

Dealmaker: Boulder Group Arranges $17M in Net Leased Asset Sales

The Boulder Group, Wilmette, Ill., arranged $16.5 million in single-tenant net leased asset sales.

Quote

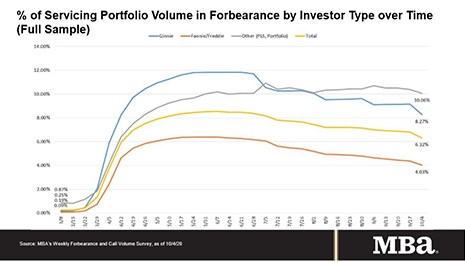

“Nearly two-thirds of borrowers who exited forbearance remained current on their payments, repaid their forborne payments or moved into a payment deferral plan. All of these borrowers have been able to resume – or continue – their pre-pandemic monthly payments.”

–MBA Chief Economist Mike Fratantoni.

MBA: Share of Mortgage Loans in Forbearance Drops to 6.32%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 49 basis points to 6.32% of servicers’ portfolio volume in the prior week as of October 4 from 6.81% the previous week. MBA estimates 3.2 million homeowners are in forbearance plans.

Commercial/Multifamily Briefs Oct. 15, 2020

Enterprise Housing Credit Investments, Columbia, Md., closed a $295.5 million multi-investor Low-Income Housing Tax Credit fund to support the creation of 2,657 housing units, most of which will be affordable, across 30 properties in 16 states.

Quote

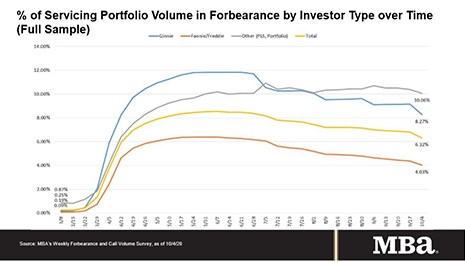

“Nearly two-thirds of borrowers who exited forbearance remained current on their payments, repaid their forborne payments or moved into a payment deferral plan. All of these borrowers have been able to resume – or continue – their pre-pandemic monthly payments.”

–MBA Chief Economist Mike Fratantoni.

MBA: Share of Mortgage Loans in Forbearance Drops to 6.32%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 49 basis points to 6.32% of servicers’ portfolio volume in the prior week as of October 4 from 6.81% the previous week. MBA estimates 3.2 million homeowners are in forbearance plans.