Despite the lowest 30-year fixed rates in the history of the Mortgage Bankers Association’s Weekly Applications Survey, mortgage applicants appeared to step back for the week ending Oct. 9.

Category: News and Trends

Quote

“Refinance and purchase activity continue to run well ahead of last year’s pace, fueled by record-low rates and strong homebuyer demand. Housing supply is a challenge for many aspiring buyers, but activity should continue to stay strong the rest of the year.”

–Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting.

MBA Premier Member Profile: Seyfarth Shaw LLP

With more than 900 lawyers across 17 offices, Seyfarth Shaw LLP provides transactional, advisory and litigation legal services to clients worldwide.

Join the Radian Everyday Heroes Challenge, Benefiting the MBA Opens Doors Foundation

This year, as part of the MBA Annual Convention & Expo and ConcertMBA, Radian has launched the Radian Everyday Heroes Challenge, which celebrates the heroes among us who are making a positive impact, while also supporting the MBA Opens Doors Foundation.

What to Expect When Expecting Distress: A Servicer Roundtable

As COVID-19 and government responses continue to drive uncertainty around outcomes and outlooks, MBA Newslink interviewed senior professionals from a credit rating agency and several highly rated servicers to get their perspective on forbearance, loan workouts and portfolio management challenges for agency and non-agency CMBS.

MBA Urges FHFA to Extend Current GSE Affordable Housing Goals

The Mortgage Bankers Association, in a letter this week to the Federal Housing Finance Agency, said FHFA should extend current affordable housing goals for Fannie Mae and Freddie Mac, given current economic uncertainty.

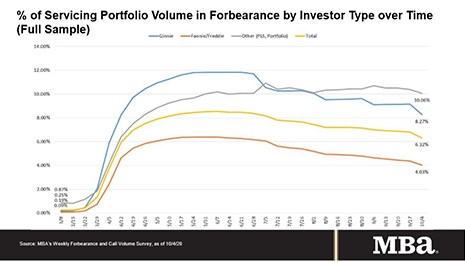

MBA: Share of Mortgage Loans in Forbearance Drops to 6.32%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 49 basis points to 6.32% of servicers’ portfolio volume in the prior week as of October 4 from 6.81% the previous week. MBA estimates 3.2 million homeowners are in forbearance plans.

Sponsored Content from Nomis Solutions: What Are Mortgage Shoppers Looking for in 2020 and Beyond?

We focused on the importance of pricing along the customer journey: during the hunt for a loan, when comparing lenders before completing an application, and (given the ease of comparing prices online these days) whether consumers continue to shop once their application is underway. From this, we identified five insights that will guide lenders as they evolve and enhance their pricing capabilities.

Sponsored Content from Pavaso: Data Privacy and Working with eClosing Service Providers

With eClosings on the rise and remote online eClosings in demand during the COVID-19 pandemic, many lenders and settlement providers are eager to extend these services to their customers. There are many important factors to consider when selecting an eClosing technology service provider.

Lawson Hardwick: Maintaining Company Culture to Put Out Flames of Rapid-Fire Hiring

It is important to hire mindfully and focus on maintaining company culture during times of rapid expansion. Otherwise, it is easy to unknowlingly compromise culture. While drawing people in the door to help relieve the existing workload, some push through the hiring process too quickly and hire people who are not the right fit.