Since widespread emergence of COVID-19, the Mortgage Bankers Association has focused on providing content, education and networking opportunities in ways we’d never imagined.

Category: News and Trends

National Association of Insurance Commissioners Adopts MBA/ACLI Proposals

A National Association of Insurance Commissioners working group adopted risk-based capital guidance and reporting instructions to implement the Mortgage Bankers Association/American Council of Life Insurers-proposed Risk-Based Capital reporting of 2020 Net Operating Income.

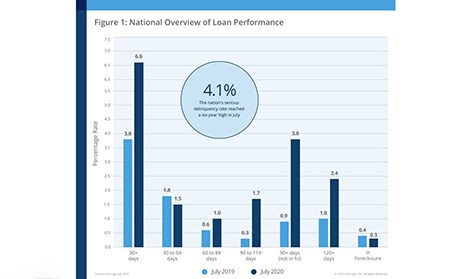

CoreLogic: Serious Delinquencies Spiking Despite Strong Housing Demand

CoreLogic, Irvine, Calif., reported an increase in overall mortgage delinquency rates in July—and in particular, a spike in serious delinquencies to their highest level in more than six years.

Concert MBA: John Ondrasik of Five For Fighting

Concert MBA, long a member favorite at the MBA Annual Convention & Expo, takes a different tack this year as we go virtual. This year, the musical retrospective will feature MBA favorite singer/songwriter John Ondrasik of Five for Fighting, who will guide viewers on a musical journey highlighting the most memorable performers and performances from past Concert MBA events.

Women in Leadership: An Interview with Cristy Ward of Mortgage Connect

Cristy and I sat down on October 13th and discussed the current state of the market and the trends we are observing in default management servicing.

MBA Annual Convention Sponsors

The Mortgage Bankers Association thanks its sponsors of the 2020 Annual Convention & Expo:

MBA Annual Convention Breakout Sessions/Special Events

Breakout sessions are the heart and soul of the Mortgage Bankers Association’s Annual Convention & Expo. These sessions provide in-the-weeds discussions and insights from expert panelists on the most relevant topics to your business in these challenging times.

MBA Annual20: Speaker Bios

Here is a list of speakers/bios participating in the Mortgage Bankers Association’s Annual Convention & Expo (Annual20), Oct. 19-21.

MBA Annual20 General Sessions: The State of the Industry and Much More

General Sessions have always been the foundation of the MBA Annual Convention & Expo, and this year is no exception. MBA has assembled a stellar lineup of keynote speakers—Administration officials, historians, journalists, sports figures, industry experts—to inform, engage and entertain.

MBA Annual20: Schedule at a Glance

Here is an easy reference schedule for the MBA Annual Convention & Expo, scheduled to take place online Oct. 19-21. For more information, visit the Convention website.