Lenders are seeing record-breaking volume month over month, and it doesn’t seem to be slowing down. One thing that has slowed down across the industry, however, is appraisal turn times. As the volume of loans requiring appraisals goes up, the number of appraisers seems to be going in the opposite direction.

Category: News and Trends

Women in Leadership: An Interview with Cristy Ward of Mortgage Connect

Cristy and I sat down on October 13th and discussed the current state of the market and the trends we are observing in default management servicing.

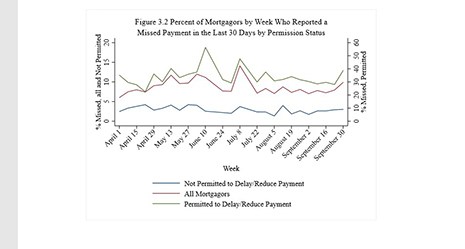

RIHA Study: More than 6 Million Renters and Homeowners and 26 Million Student Debt Borrowers Missed September Payment

More than six million households did not make their rent or mortgage payments, and 26 million individuals missed their student loan payment in September, according to third quarter research released today by the Mortgage Bankers Association’s Research Institute for Housing America.

Report Highlights Post-Pandemic Real Estate Opportunities

The pandemic is accelerating many existing real estate trends and spawning some new ones, PwC and The Urban Land Institute said in their Emerging Trends in Real Estate 2021 report.

Dealmaker: Fantini & Gorga Arranges $17M in New Hampshire, New York

Fantini & Gorga, Boston, secured $17.3 million for multifamily, mixed-use and retail assets in New Hampshire and New York.

MBA Annual20 Begins This Monday

The Mortgage Bankers Association’s first-ever virtual Annual Convention & Expo is just around the corner, beginning this Monday, Oct. 19 and running through Wednesday, Oct. 21.

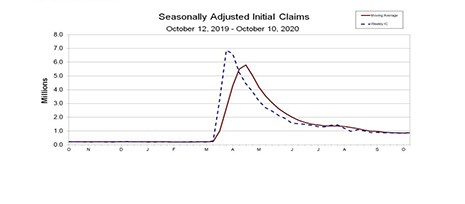

Initial Claims Rise to 898K; Labor Market Remains ‘Precarious’

The labor market remains under stress, as evidenced by yesterday’s initial claims report from the Labor Department, which showed claims rising for the second straight week to its highest level since August.

MISMO Approves Reference Model 3.4

MISMO®, the mortgage industry’s standards organization, today announced that its widely adopted MISMO 3.4 Reference Model has been upgraded to “Recommendation” status. This status is the highest possible maturity level that can be bestowed on a MISMO standard.

Rachael Sokolowski and Rick Triola: Impediments to Interstate Commerce Eliminated by Passage of The Secure Notarization Act

What ever happened to Senate Bill 3533, the Securing and Enabling Commerce Using Remote and Electronic Notarization Act of 2020 (the “SECURE Act”), bipartisan legislation to authorize and establish minimum standards for electronic and remote notarizations (RON), which was introduced in mid-March? We assert that this question would be on more lips and in more headlines had not nearly every state in the Union either adopted its own version of the law or enacted pandemic-necessitated workarounds.

Quote

“There is growing concern that absent a slowdown in the number of coronavirus cases and another round of much-needed federal aid, millions of renters in the coming months face the prospects of falling further behind.”

–Gary V. Engelhardt, Professor of Economics in the Maxwell School of Citizenship and Public Affairs at Syracuse University and co-author of a Research for Housing Institute America study on financial distress during the coronavirus pandemic.