In his keynote address on Oct. 19, MBA President & CEO Robert Broeksmit, CMB, discusses the remarkable events of the past year.

Category: News and Trends

Susan Stewart Takes Charge as MBA 2021 Chair

Susan Stewart has worked in mortgage banking since she was 24. She has grown SWBC Mortgage, San Antonio, Texas, from a small regional bank with three employees in 1989 to a full-service origination-to-servicing organization with 70 branches serving 43 states with 680 employees.

Brian Stoffers, CMB, Reflects on Year as MBA Chairman

Brian Stoffers, CMB, served as Chairman of the Mortgage Bankers Association during perhaps the most interesting year in its history—not that he or anyone else planned it that way.

Dealmaker: Marcus & Millichap Brokers $77M in Property Sales

Marcus & Millichap, Calabasas, Calif., brokered the sale of a five-story, 123-room hostel in downtown San Francisco. The building sold for $19 million.

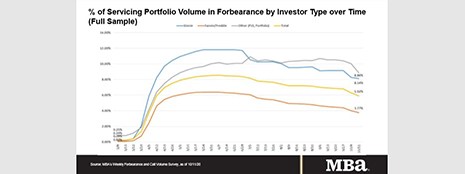

MBA: Share of Mortgage Loans in Forbearance Falls to 5.92%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 40 basis points to 5.92% of servicers’ portfolio volume as of October 11, from 6.32% the prior week. MBA now estimates 3.0 million homeowners are in forbearance plans.

Quote

“MBA was made for times of crisis. This is when our hard work of building relationships really pays off.”

–MBA President & CEO Robert Broeksmit, CMB.

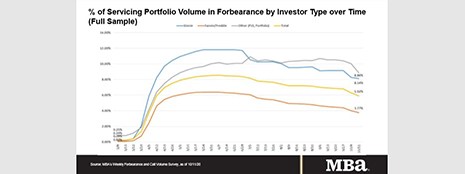

MBA: Share of Mortgage Loans in Forbearance Falls to 5.92%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 40 basis points to 5.92% of servicers’ portfolio volume as of October 11, from 6.32% the prior week. MBA now estimates 3.0 million homeowners are in forbearance plans.

Quote

“Homeownership is the foundation for generational wealth and social mobility. I don’t see this as a dream. We have the ability together to make our world better, so let’s make that happen. This is a mission worthy of the MBA.”

–Newly elected MBA Chair Susan Stewart.

Andrew Weiss of Origence on Managing Customer Engagement

Andrew Weiss is Senior Vice President of Mortgage Origination Platform Strategy with Origence, Irvine, Calif., a provider of lending technology and platforms for the financial services industry. He has more than 30 years of experience in the mortgage and consumer lending space and was instrumental in developing Desktop Underwriter while working for Fannie Mae.

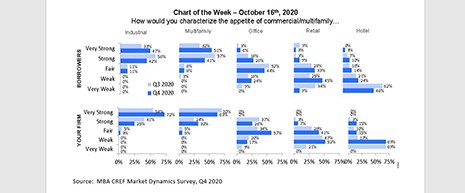

MBA Chart of the Week: Appetite for Commercial/Multifamily

CRE mortgage demand is generally on the rise, with four times more firms expecting borrower demand to be “very strong” in the fourth quarter (24%), compared to the 6% who believed demand was “very strong” in the third quarter.