“You will look back and remember 2020 as a banner year; 2021, particularly the second half, should be a year of continued purchase growth and slowing refinance activity.”

–MBA Chief Economist Mike Fratantoni.

“You will look back and remember 2020 as a banner year; 2021, particularly the second half, should be a year of continued purchase growth and slowing refinance activity.”

–MBA Chief Economist Mike Fratantoni.

“For us to play our role in all markets, both good and bad and large and small, we have to do it safely and soundly with long-term risk management in mind…The GSEs are shouldering significant risks associated with the pandemic. As the principal risk-taker, we have to price that risk appropriately.”

–Fannie Mae CEO Hugh Frater, defending a 50-basis point “Adverse Market Refinance Fee” that goes into effect Dec. 1.

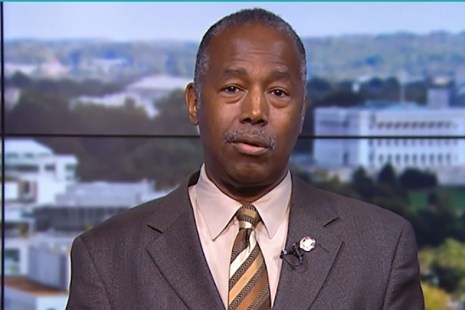

HUD Secretary Ben Carson yesterday announced the Federal Housing Administration will extend the date for single-family homeowners with FHA-insured mortgages to request an initial forbearance from their mortgage servicer for up to six months.

MBA Education, the award-winning education division of the Mortgage Bankers Association, recognized 29 individuals who earned the Certified Mortgage Banker (CMB®) designation at a ceremony held during MBA’s virtual 2020 Annual Convention & Expo.

A slight uptick in the 30-year fixed rate kept purchase applications on the sidelines last week, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending October 16.

The MBA Certified Mortgage Bankers (CMB) Society presented Alan Fowler, CMB, AMP, Senior Vice President of Mortgage Services with Nusenda Credit Union, Albuquerque, N.M., with its E. Michael Rosser, CMB, MBA Education Lifetime Achievement Award.

The Mortgage Bankers Association announced during its virtual 2020 Annual Convention & Expo that seven companies have been recognized as 2020 Diversity and Inclusion Residential Leadership Award recipients.

The Mortgage Bankers Association announced members of its Residential Board of Governors (RESBOG) and chairs of its Residential Committee for 2021.

The Mortgage Bankers Association announced its Board of Directors for the 2021 membership year during MBA’s virtual 2020 Annual Convention & Expo.

The government-sponsored enterprises have supported and provided critical liquidity to the market throughout the COVID-19 pandemic, Fannie Mae and Freddie Mac executives said.