Five federal agencies yesterday issued a proposed regulation that would codify a 2018 guidance clarifying that supervisory guidance does not have “force and effect of law.”

Category: News and Trends

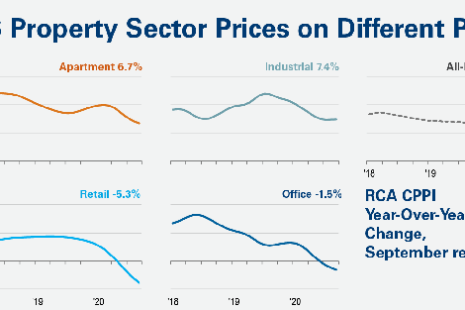

Retail, Office Prices Drop as Apartment, Industrial Gain

Real Capital Analytics, New York, reported commercial real estate price growth increased at a 1.4 percent annualized pace in September as gains in apartment and industrial sector prices offset declines in retail and office price.

Dealmaker: Capital One Closes $296M in Freddie Mac, Fannie Mae Loans

Capital One, Bethesda, Md., provided $296 million in Freddie Mac and Fannie Mae loans in Texas and Virginia.

Quote

“The pace of economic growth will slow in the fourth quarter and into next year, but expansion should nonetheless continue, provided the current spike in virus cases does not lead to another complete lockdown.”

–MBA Chief Economist Mike Fratantoni.

Rob Wiggins: 20 Years of Mortgage–A Look Back

The past 20 years in the mortgage industry have been full of change, innovation and most importantly, lessons to be learned. Even in just the past few months, mortgage lenders have had to completely transform their business processes in the wake of the COVID-19 crisis. As the industry continues to prepare for what’s next, it’s important to take a look back at how far the industry has actually come.

Call for Speakers: MBA Independent Mortgage Bankers Conference & MBA Servicing Solutions Conference; Deadline Nov. 2

The Mortgage Bankers Association has issued a Call for Speakers for two important upcoming MBA conferences: the MBA Independent Mortgage Bankers Conference 2021 (January) and the MBA Servicing Solutions Conference & Expo (February). Deadline for speaker submissions is Monday, Nov. 2.

Reimagining Office While Working from Home

How companies and their workforces will use office going forward is an increasingly popular subject in 2020. There are questions around existing buildings and how landlord business plans and those of their lenders will perform.

Sponsored Content from ServiceLink: How Technology Plays a Vital Role in Property Disposition

ServiceLink’s Ryan Helms, product manager, explains how new technology is poised to help servicers and investors make better decisions on how to manage their default portfolios.

Sponsored Content from Pavaso: Data Privacy and Working with eClosing Service Providers

Overlooking this factor when choosing an eClosing technology service provider could cost you.

Tom Lamalfa: October 2020 Survey Scorecard

In early October I surveyed 33 senior executives from 33 separate mortgage companies about a wide array of issues and topics both germane and important to the mortgage banking industry. It was the 24th time such a survey was conducted by me since 2008.