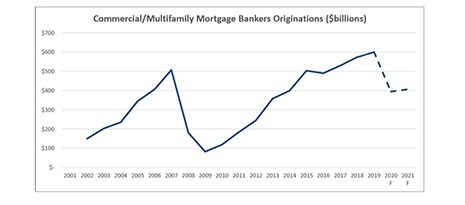

Commercial and multifamily mortgage bankers are expected to close $395 billion of loans backed by income-producing properties in 2020, a 34 percent decline from 2019’s record $601 billion, according to a new Mortgage Bankers Association forecast.

Category: News and Trends

State Regulators Advise Licensees to Renew by Nov. 30

State regulators encourage individuals and businesses that provide mortgage, money transmission, debt collection and consumer financial services to renew their licenses in Nationwide Multistate Licensing System by November 30 to avoid processing delays.

Multifamily Market Musings: Conversation with Fannie Mae’s Kim Betancourt

This year’s industry developments are dominated by the pandemic as well as associated social, political and economic impacts. Given this backdrop and the continued role of the GSEs in financing multifamily throughout market ups and downs, MBA NewsLink talked with Fannie Mae’s Kim Betancourt to get perspective on trends and what to watch as the multifamily market continues to evolve.

Paul Weakley: The Art of Engineering

So, just how do architects, stakeholders, product owners, designers and users better interact with a mortgage software engineer? The first step is to understand what an engineer is and does.

Signs of Retail Sector Distress Grow

The retail market is starting to see distress as the pandemic enters its ninth month, said Moody’s Analytics REIS, New York.

Jennifer Henry: Reducing Risk and Increasing Efficiency for Digital Mortgages with Third-Party Verifications

The digitization process has accelerated as mortgage professionals seek ways to efficiently meet the high demand for both purchase and refinance applications.

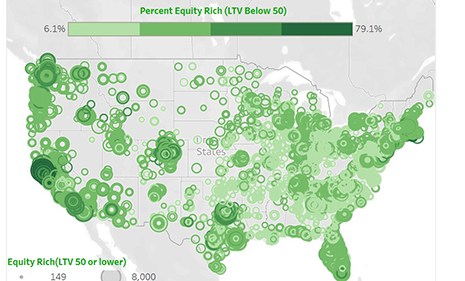

3Q Home Equity Levels Rise Despite Pandemic

ATTOM Data Solutions, Irvine, Calif., said equity-rich properties in the U.S. now outnumber those considered seriously underwater by a nearly 5-1 margin.

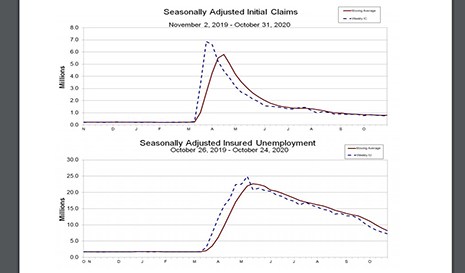

Weekly Initial Claims Remain Stubbornly High

Initial claims for unemployment insurance fell by just 7,000 for the week ending Oct. 31, the Labor Department reported yesterday.

Dealmaker: Greystone Provides $48M for Two Multifamily Assets

Greystone, New York, provided $48.2 million in HUD-insured loans to refinance multifamily properties in Virginia and Arizona.

MBA Forecast: 2020 Commercial/Multifamily Lending Down 34% from 2019 Record Volumes

Commercial and multifamily mortgage bankers are expected to close $395 billion of loans backed by income-producing properties in 2020, a 34 percent decline from 2019’s record $601 billion, according to a new Mortgage Bankers Association forecast.