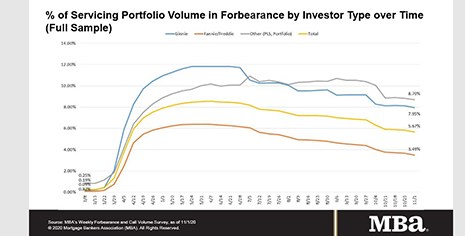

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 16 basis points to 5.67% of servicers’ portfolio volume as of Nov. 1, from 5.83% the prior week. MBA now estimates 2.8 million homeowners are in forbearance plans.

Category: News and Trends

Quote

“Unlike the last crisis, the housing market, your companies and our industry are at the forefront of the recovery. Your companies and your customers are the engine that will power America back to brighter days.”

–MBA President & CEO Robert Broeksmit, CMB, speaking yesterday at the virtual MBA Regulatory Compliance Conference.

MBA Advocacy Update–Nov. 9, 2020

MBA continues to closely monitor the results of our national elections and will provide a more thorough analysis as remaining details are finalized. In addition, MBA is closely tracking three California ballot initiatives that impact the real estate finance industry.

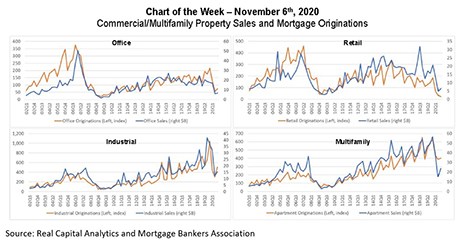

MBA Chart of the Week: Commercial/Multifamily Property Sales & Mortgage Originations

Commercial and multifamily mortgage origination volumes tend to move nearly in lockstep with property sales activity. With the onset of the COVID-19 pandemic, both tumbled, but with some important caveats.

Trevor Gauthier of ACES Quality Management on Early Payment Defaults

Trevor Gauthier is CEO of ACES Quality Management, formerly known as ACES Risk Management (ARMCO). He has more than 20 years of executive experience in leading growth initiatives for tech organizations and building teams both organically and through acquisition.

Jennifer Henry: Reducing Risk and Increasing Efficiency for Digital Mortgages with Third-Party Verifications

The digitization process has accelerated as mortgage professionals seek ways to efficiently meet the high demand for both purchase and refinance applications.

Paul Weakley: The Art of Engineering

So, just how do architects, stakeholders, product owners, designers and users better interact with a mortgage software engineer? The first step is to understand what an engineer is and does.

Sponsored Content from Nationwide Title Clearing: Making a Sale or Partnering?

Selling and delivering as a business partner in today’s market, with Nationwide Title Clearing VP of Sales & Marketing, Danny Byrnes.

MBA Congratulates Joe Biden on Election as President

Mortgage Bankers Association President & CEO Robert D. Broeksmit, CMB, issued the following statement congratulating Joseph R. Biden Jr. on his election as 46th President of the United States:

MBA Advocacy Update–Nov. 9, 2020

MBA continues to closely monitor the results of our national elections and will provide a more thorough analysis as remaining details are finalized. In addition, MBA is closely tracking three California ballot initiatives that impact the real estate finance industry.