The digitization process has accelerated as mortgage professionals seek ways to efficiently meet the high demand for both purchase and refinance applications.

Category: News and Trends

Quote

“While the steady return to normal pre-pandemic routines brings a sense of optimism, the economic impact of COVID-19 will have a lingering effect, particularly on renters who owe back rent and were protected by eviction moratoriums. We found that there is likely enough rental assistance available, and the deployment and accessibility of these funds is vital to supporting renters and property owners in need as the country transitions to a post-pandemic normal.”

–Corey Aber, Freddie Mac Senior Director of Mission, Policy and Strategy.

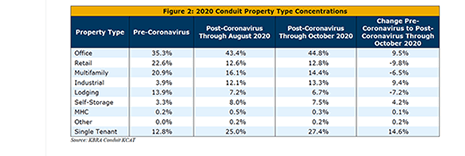

CMBS Delinquency Rate Falls; Issuance Bounces Back

The commercial mortgage-backed securities delinquency rate continued to fall in October while issuance increased, said Trepp LLC and KBRA, New York.

CoreLogic: Foreclosures Remain Low; Serious Delinquencies Continue to Build Up

Ahead of this morning’s quarterly National Delinquency Survey from the Mortgage Bankers Association, CoreLogic, Irvine, Calif., said the 150-day delinquency rate reached its highest level since January 1999, noting that forbearance provisions have helped foreclosure rates maintain historic lows.

Dealmaker: CBRE Brokers $111M in California Sales

CBRE, Los Angeles, brokered two property sales in San Diego’s Kearny Mesa neighborhood for $111.3 million.

6 Months into COVID, More Than Half of Americans Have Difficulty Paying Down Debt

More than half of respondents to a survey conducted by BAI, Chicago, and the National Foundation for Credit Counseling said the coronavirus pandemic has affected their personal finances, making it difficult to pay some debts.

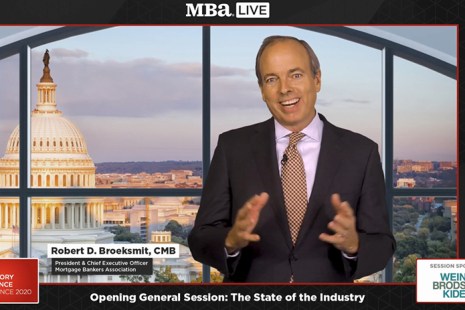

Broeksmit: ‘MBA Was Made for Times of Crisis’

In remarks yesterday during the Mortgage Bankers Association’s virtual Regulatory Compliance Conference, MBA President & CEO Robert Broeksmit, CMB, said the extraordinary events of 2020 have tested everyone’s mettle—including that of MBA.

MAA Post-Election Update Nov. 19

The MBA Mortgage Action Alliance Post-Election Update, taking place Thursday, Nov. 19 from 2:00-3:00 p.m. ET, provides MAA members (and prospective MAA members) with a briefing on election results to date and the anticipated impacts on the industry.

Quote

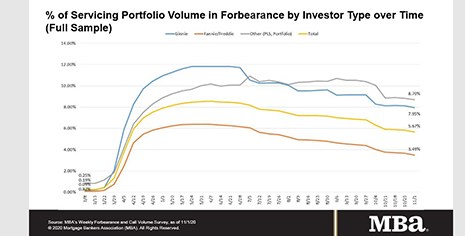

“With declines in the share of loans in forbearance across the board, the data this week align well with the positive news from October’s jobs report, which showed a gain of more than 900,000 private sector jobs and a 1 percentage point decrease in the unemployment rate. A recovering job market, coupled with a strong housing market, is providing the support needed for many homeowners to get back on their feet.”

–MBA Senior Vice President and Chief Economist Mike Fratantoni.

MBA: Share of Mortgage Loans in Forbearance Decreases to 5.67%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 16 basis points to 5.67% of servicers’ portfolio volume as of Nov. 1, from 5.83% the prior week. MBA now estimates 2.8 million homeowners are in forbearance plans.