Lenders can reduce the impact of human bias on credit decisioning by building standardized, repeatable and observable processes facilitated by machines. While there’s still value in human interactions, machines are better at ensuring fairness and auditability. You can’t see inside a human mortgage underwriter’s brain, but a computer’s memory leaves a clear trail, making bias easier to measure and safeguard against.

Category: News and Trends

Ellie Mae: Low Rates Sustain Refi Surge

Ellie Mae, Pleasanton, Calif, said interest rates below 3 percent pushed the share of refinances of closed loans to a record 60 percent in October.

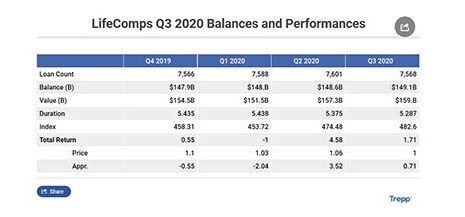

Life Insurance Commercial Mortgage Returns Stabilize, Credit Concerns Remain

Trepp, New York, said returns on life insurance commercial mortgages stabilized in the third quarter, but noted credit concerns remain

David Snitkof: 3 Ways to Use Technology to Reduce Bias in Mortgage Underwriting

Lenders can reduce the impact of human bias on credit decisioning by building standardized, repeatable and observable processes facilitated by machines. While there’s still value in human interactions, machines are better at ensuring fairness and auditability. You can’t see inside a human mortgage underwriter’s brain, but a computer’s memory leaves a clear trail, making bias easier to measure and safeguard against.

Dealmaker: Fantini & Gorga Arranges $20M for Millside at Heritage Park

Fantini & Gorga, Boston, arranged transactions totaling $19.9 million for Millside at Heritage Park, a 60-unit apartment property in Canton, Mass.

State Regulators Advise Licensees to Renew by Nov. 30

State regulators encourage individuals and businesses that provide mortgage, money transmission, debt collection and consumer financial services to renew their licenses in Nationwide Multistate Licensing System by November 30 to avoid processing delays.

October Existing Home Sales Stay Strong

Existing home sales continued to trend upward in October, marking five consecutive months of month-over-month gains, the National Association of Realtors reported yesterday.

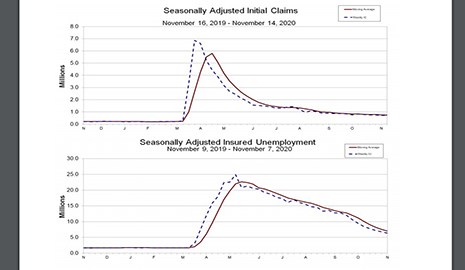

Initial Unemployment Claims Suffer Setback

Initial claims for unemployment insurance rose for the week ending Nov. 14, hamstrung by a dramatic jump in coronavirus cases and no sign of a new economic stimulus program before next year.

MBA Opens Doors Foundation Receives $153,000 From EPM ‘Choose Kindness’ Campaign

The MBA Opens Doors Foundation announced it received $153,634 from Equity Prime Mortgage’s Choose Kindness campaign, including a personal donation of $26,300 from Eddy Perez, CMB, President and CEO of EPM.

FHFA Sets Final Rule for GSE Regulatory Capital Framework

The Federal Housing Finance Agency yesterday released a final rule that establishes a new regulatory capital framework for Fannie Mae and Freddie Mac.