The Conference Board, New York, said its Consumer Confidence Index fell again in November amid a sharp spike in coronavirus cases nationwide.

Category: News and Trends

FHFA: 2021 GSE Conforming Loan Limits Increase to $548,250

The Federal Housing Finance Agency yesterday announced a nearly $40,000 jump in maximum conforming loan limits for mortgages to be acquired by Fannie Mae and Freddie Mac in 2021.

Dealmaker: Capital One Closes $33M in Freddie Mac, Fannie Mae Loans

Capital One, Bethesda, Md., provided $33.3 million in Fannie Mae and Freddie Mac loans to refinance three Los Angeles-area apartment communities.

The Wonder Years: Freddie Mac’s K Series Turns 11

Freddie Mac’s K series quietly holds a place as an important, innovative multifamily market solution that has served borrowers, lenders, tenants and bondholders extremely well since its inception. Importantly for a government-sponsored entity, it also serves as a mechanism to transfer risk away from taxpayers.

People in the News Nov. 25 2020

Planet Home Lending LLC, Meriden, Conn., promoted Dalila Ramos to Vice President of Talent Acquisition to support recruiting efforts and attract talent.

Mark P. Dangelo: Lead, Follow or be Run Over

As we investigate 2021, one thing is certain, technology will be the innovation mantra pushing mortgage bankers and their high-touch processes into realities such as straight-through processing. These advanced technical innovations will challenge FSBO’s to think very, very differently.

Quote

“Weekly mortgage rate volatility has emerged again, as markets respond to fiscal policy uncertainty and a resurgence in COVID-19 cases around the country. The decline in rates ignited borrower interest, with applications for both home purchases and refinancing increasing on a weekly and annual basis.”

–Joel Kan, MBA Associate Vice President of Industry and Economic Forecasting.

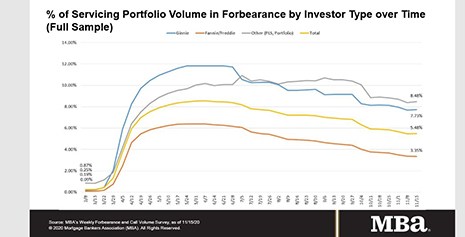

MBA: Share of Mortgage Loans in Forbearance Edges Up to 5.48%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 5.48% of mortgage servicers’ portfolio volume as of November 15, from 5.47% the week before. MBA estimates 2.7 million homeowners are in forbearance plans.

State Regulators Advise Licensees to Renew by Nov. 30

State regulators encourage individuals and businesses that provide mortgage, money transmission, debt collection and consumer financial services to renew their licenses in Nationwide Multistate Licensing System by November 30 to avoid processing delays.

Debarchana Roy: Touchless Covid-Tech to Support Customer Well-Being, Customer Engagement

The shift to digital-first technology has accelerated greatly. Once far on the horizon, digital adoption is no longer an option. Lenders must embrace digital solutions and explore augmented technology to meet consumers where they are and on their own time.