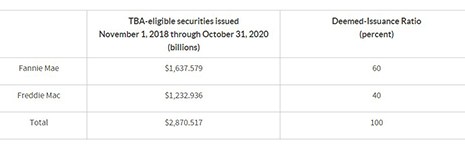

The Federal Housing Finance Agency announced the deemed-issuance ratio for the 2021 calendar year in accordance with Internal Revenue Service guidelines on trading of the Uniform Mortgage-Backed Security will remain unchanged in 2021 at 60 percent Fannie Mae and 40 percent Freddie Mac.

Category: News and Trends

Deep End of the CMBS Pool: A Conversation with KBRA Analysts

KBRA just released its 2021 Sector Outlook: CMBS: Slow and Steady report. As the real estate finance industry grapples with increased infection rates approaching the holiday season and how to think about 2021, MBA NewsLink sat down with KBRA’s Patrick McQuinn and Sacheen Shah to get their insights.

Industry Briefs Dec. 1, 2020

Fitch Ratings, Chicago, said while the ongoing coronavirus pandemic has negatively impacted the broader economy, the title insurance industry remains positioned for favorable margins with positive housing and mortgage market fundamentals heading into 2021.

Dealmaker: Axiom Capital Corp. Arranges $25M for Retail Properties

Axiom Capital Corp. Montclair, N.J., arranged $25.3 million in financing for two New York retail assets.

Commercial Real Estate Investment Up, But Caution Prevails

JLL, Chicago, said global real estate investment improved in the third quarter, but COVID-19 uncertainty continues to hamper markets.

MBA State of the Association Dec. 2

The Mortgage Bankers Association’s annual State of the Association takes place Wednesday, Dec. 2 from 3:00-4:00 p.m. ET.

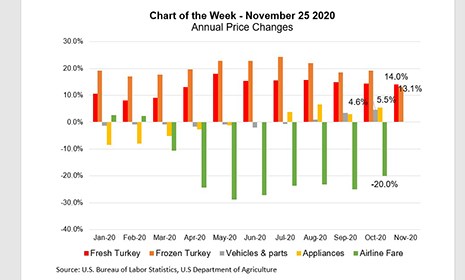

MBA Chart of the Week: Annual Price Gains

Our Thanksgiving-themed Chart of the Week highlights the strength in turkey price growth in 2020, along with year-over-year price changes for a few other goods categories.

Quote

“As we approach the end of an uncertain year, transaction pipelines are rebuilding globally and are offering a sense of optimism,” he said. “Investors will remain cautious and calculated in their approach while opportunistic and high-net-worth investors are poised to capitalize on market fragmentation while institutions remain critical of pricing.”

–Sean Coghlan, Head of Capital Markets Research with JLL, Chicago.

Sponsored Content from ServiceLink: Selecting an AMC for Today’s Market

Looking to work with an AMC partner? Here are some areas to consider as you make your choice.

MBA Announces 2021 Commercial Real Estate/Multifamily Finance Board of Governors

The Mortgage Bankers Association announced members of its Commercial Real Estate/Multifamily Finance Board of Governors (COMBOG) for 2021.