The non-QM market is making a recovery and, with continued demand from borrowers, changes to the current QM lending rule and the approaching expiration of the QM patch, is likely to stay on the rebound. As a new range of products come to the market, the question now becomes, how can the mortgage industry ramp up and ensure loan quality for lenders, servicers, and investors?

Category: News and Trends

Quote

“With the surge in mortgage production volume in the third quarter, net production profits among independent mortgage bankers increased, surpassing 200 basis points for the first time since the inception of MBA’s report in 2008. Soaring production revenues – led by strong secondary marketing gains – drove these results and more than offset an increase in production expenses.”

–MBA Vice President of Industry Analysis Marina Walsh, CMB.

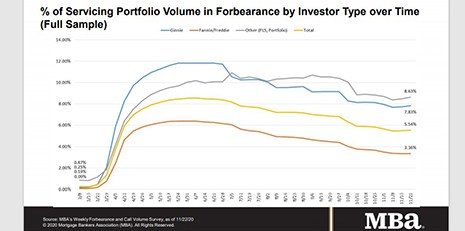

MBA: Share of Mortgage Loans in Forbearance Increases to 5.54%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 5.54% of servicers’ portfolio volume as of November 22, 2020 from 5.48% the prior week. MBA estimates 2.8 million homeowners are in forbearance plans.

Deep End of the CMBS Pool: A Conversation with KBRA Analysts

KBRA just released its 2021 Sector Outlook: CMBS: Slow and Steady report. As the real estate finance industry grapples with increased infection rates approaching the holiday season and how to think about 2021, MBA NewsLink sat down with KBRA’s Patrick McQuinn and Sacheen Shah to get their insights.

Sponsored Content from ServiceLink: Selecting an AMC for Today’s Market

Looking to work with an AMC partner? Here are some areas to consider as you make your choice.

‘Sluggish’ Acquisitions Slow Third-Quarter Commercial Lending Activity

“Sluggish” commercial real estate investment activity caused loan closings to slow in the third quarter, reported CBRE, Los Angeles.

Dealmaker: Phillips Realty Capital Structures $142M Lease-Up Bridge Financing

Phillips Realty Capital, Bethesda, Md., originated a $141.7 million bridge loan to recapitalize The Sur, a recently delivered 360-unit apartment community near Amazon’s HQ2 in Arlington, Va.

Mortgage Applications Dip Slightly in MBA Weekly Survey

Despite sustained record-low interest rates, mortgage applications dipped slightly during the holiday-shortened Thanksgiving week, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending November 27.

Dave Parker: Rebounding Non-QM Market Requires Quality Review to Mitigate Risk

The non-QM market is making a recovery and, with continued demand from borrowers, changes to the current QM lending rule and the approaching expiration of the QM patch, is likely to stay on the rebound. As a new range of products come to the market, the question now becomes, how can the mortgage industry ramp up and ensure loan quality for lenders, servicers, and investors?

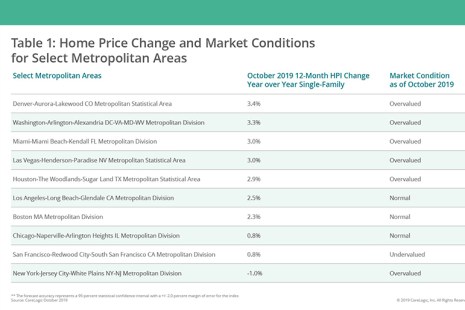

‘Gaining Momentum’: October Annual U.S. Home Prices Up 7.3%

CoreLogic, Irvine, Calif., said home prices increased by 7.3% in October from a year ago, marking the fastest annual appreciation since April 2014.