Grandbridge Real Estate Capital, Charlotte, N.C., arranged $113.5 million for office and apartment properties in Minnesota and Virginia.

Category: News and Trends

Refis Up, Purchases Down in MBA Weekly Survey as Rates Hit New Low

With mortgage interest rates falling yet again to record lows, homeowners took advantage to refinance; purchase buyers, not so much, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending December 4.

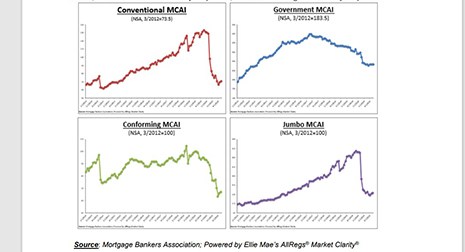

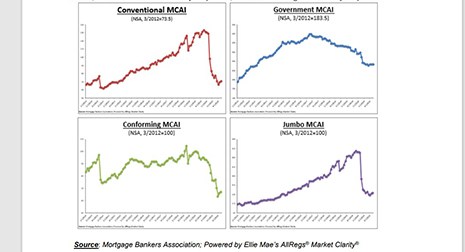

Mortgage Credit Availability at 4-Month High

Mortgage credit availability increased in November to its highest level since July, the Mortgage Bankers Association reported this morning.

Quote

“Refinance activity increased last week in response to mortgage rates for 30-year, 15-year and FHA loans hitting their lowest levels in MBA’s survey…the ongoing refinance wave has continued through the fall, with activity last week up 89 percent from a year ago.”

–Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting.

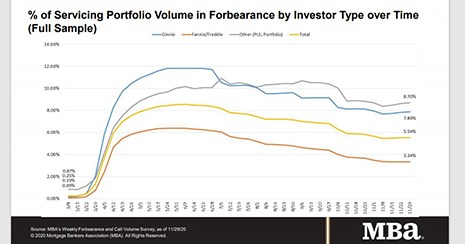

MBA: Share of Loans in Forbearance Flat at 5.54%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance remained unchanged from the prior week at 5.54% as of November 29. MBA estimates 2.8 million homeowners are in forbearance plans.

Sponsored Content from ServiceLink: Loss Mitigation–How Partnering with the Right Solutions Provider Can Help

As the CARES Act has been welcome relief to borrowers, many servicers are finding their own relief in strategic partnerships.

Bruno Pasceri: The Transformation Ahead

MBA NewsLink interviewed Bruno Pasceri, President of Incenter LLC and a mortgage industry leader for more than 30 years, about the mortgage banking market and how to navigate future changes.

MBA Mortgage Action Alliance Steering Committee Elections Open through COB Today

The Mortgage Bankers Association’s grassroots advocacy arm, the Mortgage Action Alliance, is holding elections for three at-large seats on its 2021-2022 MAA Steering Committee. The active voting period will be open until Wednesday, Dec. 9 at 5:00 p.m. ET.

People in the News Dec. 9, 2020

The Mortgage Bankers Association announced Borden Hoskins joined the association as Associate Vice President of Legislative Affairs. He will be responsible for advocating MBA’s legislative and policy priorities on Capitol Hill, with a primary focus on Republican members of the House of Representatives.

Mortgage Credit Availability at 4-Month High

Mortgage credit availability increased in November to its highest level since July, the Mortgage Bankers Association reported this morning.