With mortgage interest rates falling yet again to record lows, homeowners took advantage to refinance; purchase buyers, not so much, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending December 4.

Category: News and Trends

Greg Holmes of Credit Plus on COVID Challenges

Greg Holmes is Managing Partner with Credit Plus Inc., Salisbury, Md., a third-party verifications company serving the mortgage industry.

MISMO Statement on FSOC Recommendation on Adoption/Use of Industry Data Standards

Seth Appleton, President of MISMO®, issued the following statement in support of the Financial Stability Oversight Council’s annual report recommendation (https://home.treasury.gov/system/files/261/FSOC2020AnnualReport.pdf) that the industry adopt and use industry data standards:

People in the News Dec. 10, 2020

The Mortgage Bankers Association announced Borden Hoskins joined the association as Associate Vice President of Legislative Affairs. He will be responsible for advocating MBA’s legislative and policy priorities on Capitol Hill, with a primary focus on Republican members of the House of Representatives.

Sponsored Content from ServiceLink: Loss Mitigation–How Partnering with the Right Solutions Provider Can Help

As the CARES Act has been welcome relief to borrowers, many servicers are finding their own relief in strategic partnerships.

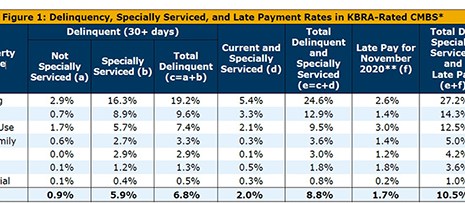

CMBS Delinquency Rate Dips

The commercial mortgage-backed securities delinquency rate dipped in November, largely due to continued Coronavirus debt relief, said Fitch Ratings, New York.

Greg Holmes of Credit Plus on COVID Challenges

Greg Holmes is Managing Partner with Credit Plus Inc., Salisbury, Md., a third-party verifications company serving the mortgage industry.

Industry Briefs Dec. 9, 2020

SimpleNexus, Lehi, Utah, announced a two-way integration with Unify’s Business Growth Platform that streamlines the loan application process to improve efficiency and help mortgage lenders reduce application abandonment.

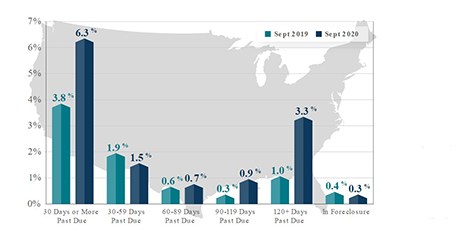

CoreLogic: Serious Delinquencies Level Off in ‘Positive Signal’

CoreLogic, Irvine, Calif., said its monthly Loan Performance Insights Report for September showed a leveling off of serious loan delinquencies, a “positive signal” that the housing finance industry is thus far adjusting to the pandemic-induced economic downturn.

MISMO Statement on FSOC Recommendation on Adoption/Use of Industry Data Standards

Seth Appleton, President of MISMO®, issued the following statement in support of the Financial Stability Oversight Council’s annual report recommendation (https://home.treasury.gov/system/files/261/FSOC2020AnnualReport.pdf) that the industry adopt and use industry data standards: