As the CARES Act has been welcome relief to borrowers, many servicers are finding their own relief in strategic partnerships.

Category: News and Trends

‘Not Ok? That’s Ok:’ Financial Services, Consumer Coalition Launches Borrower Awareness Campaign

The Mortgage Bankers Association and a broad coalition of financial services stakeholders – including mortgage servicers, trade associations, housing counseling agencies, governmental agencies and think tanks – recently launched a consumer awareness campaign to reach borrowers who have missed one or more mortgage payments as a result of the COVID-19 pandemic and may be eligible for forbearance assistance under the CARES Act or other forms of mortgage payment relief.

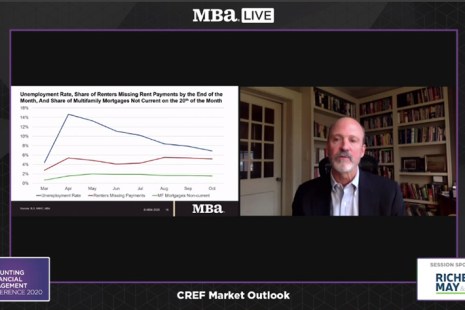

CREF Market Outlook: Commercial Real Estate’s Four-Bucket Theory

The pandemic has affected different commercial property types in very different ways, and they will likely perform differently when the economy bounces back, said MBA Vice President of Commercial Real Estate Research Jamie Woodwell.

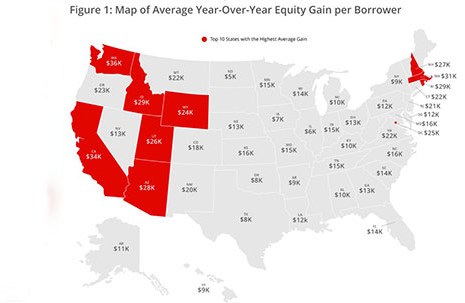

Home Equity Reaches Record High: Homeowners Gained $1 Trillion in 3Q Equity

CoreLogic, Irvine, Calif., said U.S. homeowners with mortgages saw their equity increase by 10.8% year over year in the third quarter—a collective equity gain of $1 trillion and an average gain of $17,000 per homeowner.

ATTOM: Fewer Foreclosure Filings as Moratoria Extend into 2021

ATTOM Data Solutions, Irvine, Calif., said foreclosure filings continued to fall last month amid the budding holiday season and federal and state foreclosure moratoria.

Dealmaker: NorthMarq Arranges $104M in Multifamily Refis

NorthMarq’s Chicago office arranged $103.5 million to refinance six multifamily assets in Iowa, Missouri and Indiana.

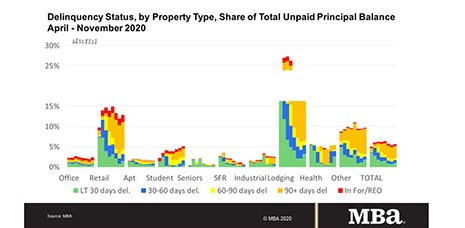

MBA: Commercial/Multifamily Mortgage Delinquency Rates Continue to Vary by Property Types, Capital Sources

Commercial and multifamily mortgage performance remains mixed, revealing the various impacts the COVID-19 pandemic has had on different types of commercial real estate, according to two reports released today by the Mortgage Bankers Association.

The Redesigned URLA Is Coming Jan. 1. Are You Ready?

Fannie Mae and Freddie Mac (the GSEs) will ring in the New Year by starting to accept the redesigned Uniform Residential Loan Application (URLA) and updated automated underwriting system (AUS) loan application submission files based on MISMO v3.4.

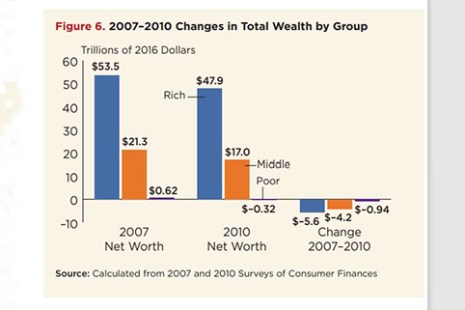

RIHA Study: Widening Inequality After Great Recession Attributed to Decline in Homeownership, Home Values

Distribution of wealth among U.S. households became increasingly unequal from 2007 through 2016 as a decline in homeownership and home values impacted the wealth of middle-class families, according to a new research report, The Distribution of Wealth Since the Great Recession, released yesterday by the Mortgage Bankers Association’s Research Institute for Housing America.

Quote

“Inequality may have improved in recent years because of the increase in home prices, the rising homeownership rate, the stock market’s steady ascent and recent policy changes that have reduced tax burdens and made it easier to save for retirement. Unfortunately, the pandemic has likely offset these changes – and especially for lower-income individuals working in jobs adversely impacted in the last nine months.”

–John C. Weicher, author of a new Research Institute for Housing America report and Director for the Center for Housing and Financial Markets at the Hudson Institute.