Is your company flying blind with incomplete or incomparable data to support key business decisions? Consider joining an elite group of 100+ lenders this spring that participate in the MBA and STRATMOR Peer Group Roundtables (PGR).

Category: News and Trends

Andrew Foster: Top Five Commercial Mortgage Servicing Issues to Watch in 2021

While most will be monitoring increased infections and the progress of vaccine distribution and effectiveness, loan servicing and asset management professionals will have some additional factors impacting their organizations and books of business in the new year

Quote

“MBA applauds the Bureau for releasing the final General and Seasoned QM rules. The revisions to these rules will preserve and expand responsible access to affordable credit while retaining core consumer protections. In particular, these rules remove cumbersome requirements for non-traditional sources of income and expand consumers’ choices. MBA appreciates the Bureau’s effort to seek stakeholder input, and we look forward to continuing to work together on other issues aimed at protecting consumers.”

–MBA President & CEO Robert Broeksmit, CMB.

Greg Holmes of Credit Plus on COVID Challenges

Greg Holmes is Managing Partner with Credit Plus Inc., Salisbury, Md., a third-party verifications company serving the mortgage industry.

The Redesigned URLA Is Coming Jan. 1. Are You Ready?

Fannie Mae and Freddie Mac (the GSEs) will ring in the New Year by starting to accept the redesigned Uniform Residential Loan Application (URLA) and updated automated underwriting system (AUS) loan application submission files based on MISMO v3.4.

CFPB Issues Final QM Mortgage, Seasoned QM Rules

The Consumer Financial Protection Bureau on Thursday issued final rules related to qualified mortgage loans. The Mortgage Bankers Association provided preliminary summaries of the final rules.

FHFA Further Extends COVID-Related Facilities

The Federal Housing Finance Agency on Thursday announced Fannie Mae and Freddie Mac would extend several loan origination flexibilities until January 31, from Dec. 31.

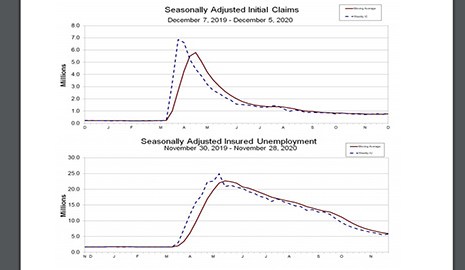

Initial Claims Keep Moving in Wrong Direction

Initial claims for unemployment insurance rose for the third time in five weeks amid signs the economy is stalling, the Labor Department reported yesterday.

MBA Statement on Marcia Fudge as HUD Secretary Nominee

President-Elect Joseph Biden this week nominated Rep. Marcia L. Fudge, D-Ohio, as HUD Secretary. If confirmed, she would be the first woman to lead HUD in more than 40 years and the second Black woman in history to lead the Department.

Institutional Investor Expectations Improve

Institutional investors expect positive full-year 2020 commercial real estate returns, but not by very much, the Pension Real Estate Association’s quarterly Consensus Forecast Survey reported.