While most will be monitoring increased infections and the progress of vaccine distribution and effectiveness, loan servicing and asset management professionals will have some additional factors impacting their organizations and books of business in the new year

Category: News and Trends

MBA Statement on CFPB Final General QM, Seasoned QM Rules

Mortgage Bankers Association President and CEO Bob Broeksmit, CMB, released the following statement regarding the final General QM and Seasoned QM Rules:

MBA Advocacy Update–Dec. 14, 2020

The CFPB released its much-anticipated final QM rules replacing the so-called GSE Patch and providing QM status for “certain” seasoned loans. Both final rules reflected important provisions advocated by MBA throughout the comment process.

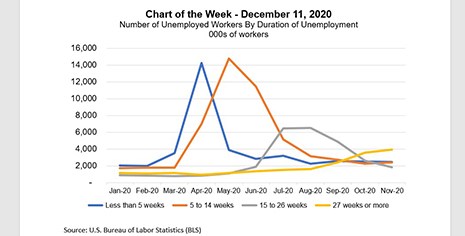

MBA Chart of the Week: Number of Unemployed Workers By Duration of Unemployment

Over the past three months, the pace of job gains has slowed from the rapid recovery seen over the summer. Similarly, the unemployment rate continues to decline, but at a more gradual pace.

Housing Market Roundup

So much news, so little time and space. The end of the year seems to bring out the volume in housing market reports, so here are a couple paragraphs each on some of the latest reports to come across our desks:

CREF CFOs Discuss the New Normal, What’s Next

Commercial real estate chief financial officers have had to move quickly to respond to the pandemic and position their firms for whatever might come next.

Scott Colclough: Amidst Uncertainty, Hedging Still Works

By maintaining a prudent hedging strategy constructed using mortgage-backed securities, mortgage lenders can match market movement on the value of borrower locks to the market in which the locks were taken.

Dealmaker: Merchants Capital Provides $22M Construction Loan

Merchants Capital, Carmel, Ind., provided $21.5 million in financing for a Minneapolis apartment community currently under construction, The Bessemer at Seward Commons.

MBA Premier Member Profile: LBA Ware

Founded in 2008, LBA Ware™, Macon, Ga., is the leading provider of automated incentive compensation management and business intelligence software for mortgage lenders. Our suite of solutions helps mortgage lenders reach new heights with software that integrates data, incentivizes performance and inspires results.

The Week Ahead—Dec. 14, 2020

We’re almost upon the holiday break—which is often the busiest time of the year here in Washington, as Congress attempts to wrap up its business and get out of town and the Mortgage Bankers Association wraps up its calendar-year activities.