A partnership between the HUD’ Office of the Chief Information Officer and HUD’s Federal Housing Commissioner, FHA Catalyst is a secure, flexible, cloud-based platform that provides a modern, automated system for lenders, servicers and other FHA program participants.

Category: News and Trends

Quote

Compared to the last two months, more homeowners exiting forbearance are using a modification – a sign that they have not been able to fully get back on their feet, even if they are working again.”

–Mike Fratantoni, MBA Senior Vice President and Chief Economist.

FHFA: GSE Non-Performing Loan Portfolios Down 70%

The Federal Housing Finance Agency’s latest report on sale of non-performing loans by Fannie Mae and Freddie Mac showed of loans one or more years delinquent held in the Enterprises’ portfolios decreased by 70 percent.

Andrew Foster: Top Five Commercial Mortgage Servicing Issues to Watch in 2021

While most will be monitoring increased infections and the progress of vaccine distribution and effectiveness, loan servicing and asset management professionals will have some additional factors impacting their organizations and books of business in the new year

Redfin: 14.5 Million Americans Will Move Out of Town in 2021, Fueling 10% Sales Growth

It’s that time of the year, folks, when prognosticators dust off their crystal balls, consult the oracles and offer their predictions for the coming year. Redfin, Seattle, kicks things off with a bold prediction: after nearly a year of the devastating effects of the coronavirus, more people will relocate in 2021 than in the previous decade.

Scott Colclough: Amidst Uncertainty, Hedging Still Works

By maintaining a prudent hedging strategy constructed using mortgage-backed securities, mortgage lenders can match market movement on the value of borrower locks to the market in which the locks were taken.

MBA, Trade Groups Urge Treasury to Promote ‘Critical Reforms’ of GSEs

More than 12 years after the federal government placed Fannie Mae and Freddie Mac under conservatorship—and seemingly no closer to moving them out of conservatorship—the Mortgage Bankers Association and several industry trade groups urged the Treasury Department to promote “critical reforms” of the GSEs and bolster their safety and soundness.

MBA: November New Home Purchase Mortgage Applications Fall by 16% Monthly; Up Nearly 35% from Year Ago

The Mortgage Bankers Association’s Builder Application Survey data for November show mortgage applications for new home purchases fell by 16 percent from October but jumped by 34.7 percent from a year ago.

Foreign Investment in U.S. Net-Lease Properties Increases Despite Travel Restrictions

CBRE, Los Angeles, said U.S. net-lease property investment rebounded during the third quarter, driven by strong interest in office assets and increasing foreign investment.

MBA: Share of Mortgage Loans in Forbearance Drops Back to 5.48%

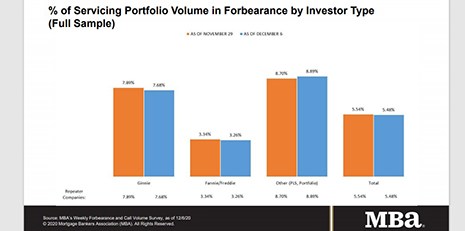

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased to 5.48% of servicers’ portfolio volume as of December 6 from 5.54% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.