November housing starts rose for the third straight month, boosted by builder confidence and strong consumer demand, HUD and the Census Bureau reported yesterday.

Category: News and Trends

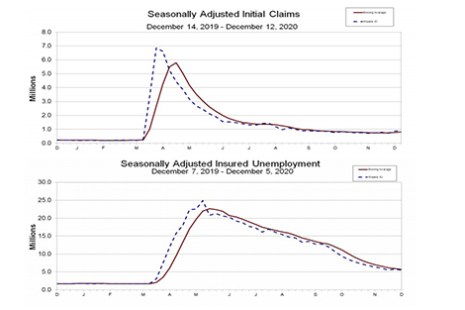

Initial Claims Continue to Backslide

Initial claims for unemployment benefits jumped for the second consecutive week, raising concerns about the sustainability of the current economy and raising alarms with unemployment benefits set to expire.

Quote

“Driven by increased demand for more indoor and outdoor space, the second half of the year continues to see more construction, home sales and mortgage originations. Additionally, permits for new single-family construction also rose to 2007 highs, potentially an indication that we might see the increase in homebuilding continue into early 2021.“

–Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting.

Fed Stays the Course: Monetary Policy ‘Quite Supportive for Housing, Mortgage Markets’

With the economy still suffering and a sharp uptick in coronavirus cases nationwide, the Federal Open Market Committee was widely expected to hold the line during its two-day policy meeting that ended yesterday. And it did.

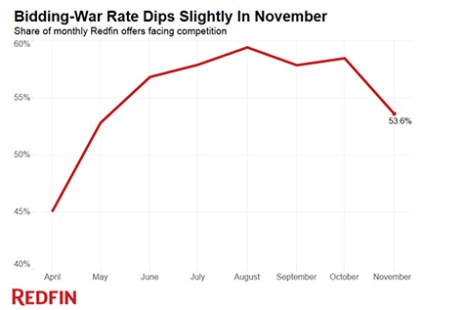

Bidding Wars Strong for 7th Straight Month; Homes Selling at Fastest Pace in 8 Years

The national median home price rose 14% year over year to $335,519 in November, according to Redfin, Seattle. And in many housing market hotspots, bidding wars persist for more than half of home sales.

Chetan Patel of Verity Global Solutions on Managing Costs in a Transitioning Market

Chetan Patel is COO of Verity Global Solutions, San Antonio, Texas, a provider of highly crafted services spanning the mortgage loan lifecycle. He has more than 25 years of leadership experience in the mortgage industry and has been recognized as an IT All-Star by Mortgage Banking magazine.

The Redesigned URLA Mandate Is Around the Corner. Will Your Technology Solution Be Ready?

December is always a busy month, and this is especially true for mortgage lenders this year. With 2021 rapidly approaching, the deadline to implement the redesigned URLA and updated automated underwriting system (AUS) datasets will be here before we know it.

MBA Premier Member Profile: LBA Ware

Founded in 2008, LBA Ware™, Macon, Ga., is the leading provider of automated incentive compensation management and business intelligence software for mortgage lenders. Our suite of solutions helps mortgage lenders reach new heights with software that integrates data, incentivizes performance and inspires results.

CRE Fundamentals Struggle to Find Secure Footing

Challenging times for CRE fundamentals are likely to extend into 2021, but there is light at the end of the tunnel, said Wells Fargo Securities, Charlotte, N.C.

Dealmaker: Graham Street Realty Acquires Colorado Industrial Property for $16M

Graham Street Realty, San Francisco, acquired industrial property Commerce Square near Denver for $16 million.