The Mortgage Bankers Association hired mortgage industry veteran Charmaine Brown to fill its newly created position of Director of Diversity and Inclusion. Brown, who will start on Jan. 4, will be responsible for developing, promoting and advancing diversity and inclusion programs for the real estate finance industry.

Category: News and Trends

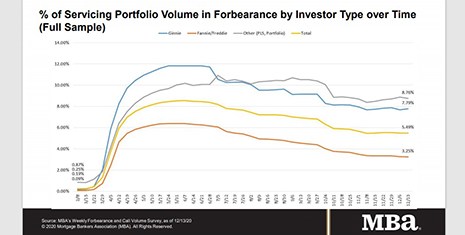

MBA: Share of Mortgages in Forbearance Ticks Up

The Mortgage Bankers Association’s latest Forbearance & Call Center Survey reported loans in forbearance increased slightly to 5.49% of servicers’ portfolio volume as of December 13 from 5.49% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

Dealmaker: Bellwether Enterprise Closes $42M for Industrial Assets

Bellwether Enterprise Real Estate Capital LLC, Cleveland, closed two loans totaling $41.5 million for distribution centers in southern California and Pennsylvania.

Low Rates Driving CMBS Defeasance Trend

Fitch Ratings, New York, said commercial mortgage-backed securities borrowers are taking advantage of the current low interest rate environment to defease their loans.

Chris Mason: ‘Dear Management’…

2020 is ending…and 2021 is coming into view. A few thoughts that should be dancing around in your head…along with those sugar plums.

MBA Advocacy Update–Dec. 21, 2020

MBA – along with several trades – sent a letter to Treasury Secretary Steven Mnuchin expressing concerns regarding the possible release of the GSEs from conservatorship. On Wednesday, FHFA released a final rule extending the current single-family and multifamily GSE affordable housing goals by one year, through 2021.

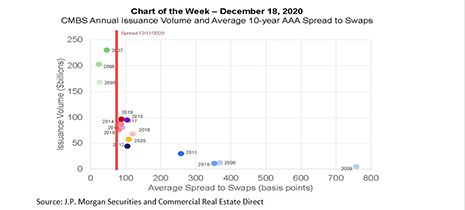

MBA Chart of the Week: CMBS Annual Issuance Volume

One way to gauge potential commercial mortgage-backed securities issuance volume is by looking at the spreads investors are willing to pay for bonds. Based on current new-issue spreads, 2021 could line-up to be a strong year.

Quote

“The share of loans in forbearance has stayed fairly level since early November, often with small decreases in the GSE loan share and increases for Ginnie Mae loan. That was the case last week. Additionally, forbearance requests from Ginnie Mae borrowers reached the highest level since the week ending June 14. Additional restrictions on businesses and rising COVID-19 cases are causing a renewed increase in layoffs and other signs of slowing economic activity. These troubling trends will likely result in more homeowners seeking relief.”

–Mike Fratantoni, MBA Senior Vice President and Chief Economist.

People in the News Dec. 22, 2020

The Mortgage Bankers Association hired mortgage industry veteran Charmaine Brown to fill its newly created position of Director of Diversity and Inclusion. Brown, who will start on Jan. 4, will be responsible for developing, promoting and advancing diversity and inclusion programs for the real estate finance industry.

MBA, Trade Groups Ask Federal Agencies for Clarity on CARES Act Forbearance

The Mortgage Bankers Association, the American Bankers Association and the Housing Policy Council on Thursday asked federal agencies to issue guidance establishing a consistent timeframe for CARES Act forbearance under their respective programs.