The recent surge in COVID-19 infections dampened U.S. hotel performance expectations, but news of effective vaccines has bolstered recovery projections beginning second-half 2021, sector analysts said.

Category: News and Trends

Industry Briefs Jan. 12, 2021

Verus Commercial Real Estate Finance, New York, launched a new product for financing of Single-Family Home Rental Portfolios.

Michael Steer: A New Year, A New Regulatory Attitude?

Should the pandemic regulatory attitude be forgot and never brought to mind? Not exactly. However, lenders can adapt the current pandemic regulatory attitude into one that pays equal mind to both the pandemic and the importance of compliance.

MBA Spring Conference & Expo Apr. 20-22

The Mortgage Bankers Association has combined all of its signature spring conferences into a single Spring Conference & Expo, taking place via MBA LIVE from Apr. 20-22.

MISMO Announces 2021 Board of Directors

MISMO announced its Board of Directors for 2021. MISMO, which is a subsidiary of and managed by the Mortgage Bankers Association, is the mortgage industry’s standards organization working to enable the industry to speak the same language.

MBA Advocacy Update: Jan. 11, 2021

On Tuesday, the Federal Housing Finance Agency released the final 2021 Underserved Markets Plans for the GSEs under the Duty to Serve program. On Monday, MBA submitted comments in support of a proposed rule on supervisory guidance issued by a group of federal financial regulators.

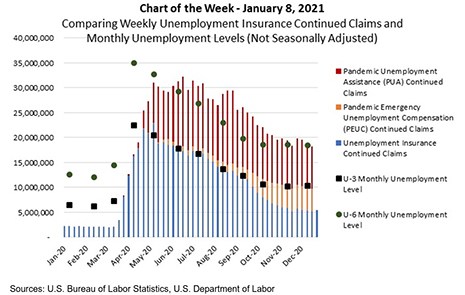

MBA Chart of the Week: Unemployment Insurance Continued Claims

The COVID-19 pandemic continued to impact the labor market to close 2020. Friday’s release from the Bureau of Labor Statistics showed that faster layoffs led to a loss of 140,000 jobs in December and kept the headline unemployment rate (U-3) at 6.7 percent.

Jim Cameron: Balance is Key for Managing Capacity and Cycle Times

When I look back on 2020, I think about what a peculiar year it’s been. And if anything, 2020 has demonstrated lenders have a lot of work to do.

Quote

“The data show that those homeowners who remain in forbearance are more likely to be in distress, with fewer continuing to make any payments and fewer exiting forbearance each month. Those borrowers who do exit are also more likely to require a modification to their ongoing repayment plans.”

–Mike Fratantoni, MBA Senior Vice President and Chief Economist.

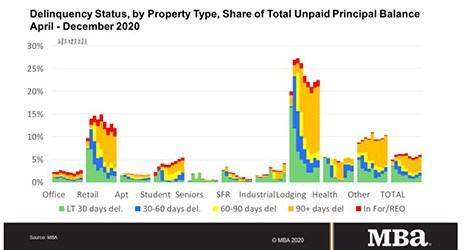

MBA: December Commercial/Multifamily Mortgage Delinquencies Rise

Delinquency rates for mortgages backed by commercial and multifamily properties Increased for the second month in a row in December, according to the Mortgage Bankers Association’s latest monthly MBA CREF Loan Performance Survey.