Should the pandemic regulatory attitude be forgot and never brought to mind? Not exactly. However, lenders can adapt the current pandemic regulatory attitude into one that pays equal mind to both the pandemic and the importance of compliance.

Category: News and Trends

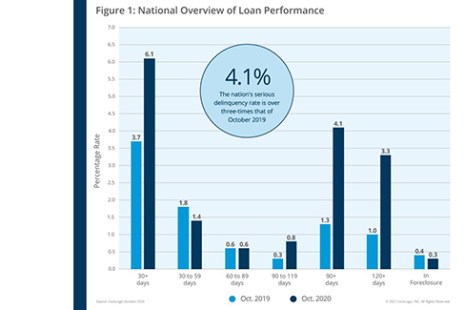

CoreLogic: Mortgage Delinquencies Rise, But Pace Moderates

CoreLogic, Irvine, Calif., said on a national level, 6.1% of mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure) in October, a 2.4-percentage point increase from a year ago, when it was 3.7%.

Pandemic Year Brings Huge Surge in ‘Million-Dollar Cities’

Move over, San Francisco Bay Area and New York City; you’ve got company—lots of it.

Larry Silver of Superus Careers on Underwriters Career Strategies

Larry Silver is CEO of Superus Careers, Fulton, Md., is a results-focused mortgage consulting firm with more than 20 years’ experience in high-growth mortgage operations.

Dealmaker: Rexford Industrial Acquires Two Industrial Portfolios for $214M

Rexford Industrial Realty, Los Angeles, acquired two industrial property portfolios for $213.7 million.

People in the News Jan. 13, 2021

Mid America Mortgage Inc., Addison, Texas, promoted former National Support and Training Director Jemma Pachiano to Chief Operating Officer.

Renters Struggle as Income Stagnates, Unemployment Remains High

Renters’ median income growth stopped last year, and more than three million renters who face COVID-19 unemployment carry extreme housing cost burdens, analysts said.

Mortgage Applications Blast Off in MBA Weekly Survey

Mortgage applications—particularly refinance applications—surged last week as key interest rates held relatively steady and borrowers took advantage, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending January 8.

MBA Voices: Courageous Conversations with Women of Color Continues Jan. 19 with ‘Can We Talk’

The Mortgage Bankers Association’s popular three-part virtual series, Voices: Courageous Conversations with Women of Color, continues Tuesday, Jan. 19 with “Can We Talk.”

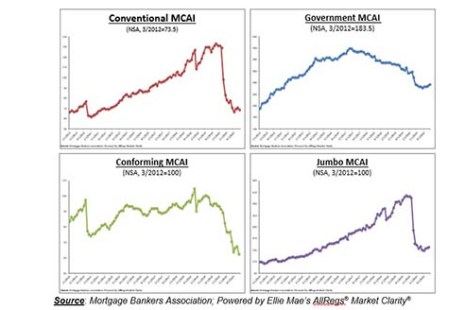

December Mortgage Credit Availability Decreases

Mortgage credit availability decreased in December, the Mortgage Bankers Association reported this morning.