Radian, Philadelphia, said performance of the U.S. residential real estate markets, and in particular home price appreciation, marks a bright spot in 2020.

Category: News and Trends

RE/MAX: ‘Record-Setting December for Housing Market

RE/MAX, Denver, said December home sales increased more than 20% year-over-year amid record-low housing inventories.

MBA, Trade Groups Ask Biden to Create $25 Billion Housing Assistance Fund

The Mortgage Bankers Association and nearly 40 industry trade groups, community organizations and real estate businesses yesterday asked President Joseph Biden Jr. to include a $25 billion Housing Assistance Fund as part of the Administration’s proposed $1.9 trillion pandemic relief package.

Housing Starts Finish 2020 on Strong Note

Housing starts rose for the second straight month in December and finished the year at its strongest pace since 2006, HUD and the Census Bureau reported yesterday.

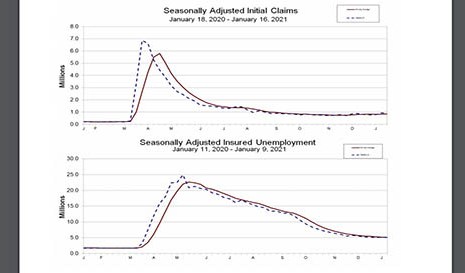

Unemployment Claims Remain Elevated

Initial claims for unemployment insurance fell by 26,000 from the week before, the Labor Department reported yesterday, but remain elevated in the wake of economic instability resulting from the coronavirus pandemic.

HUD Extends FHA Foreclosure/Eviction Moratorium through Mar. 31

HUD yesterday extended the moratorium on FHA single-family foreclosures and evictions through Mar. 31.

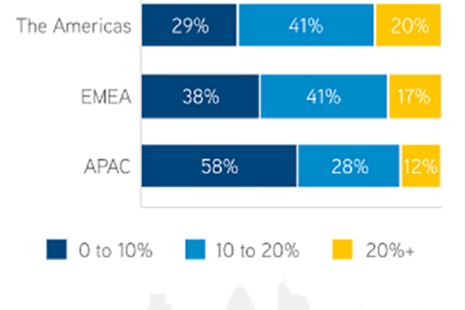

Global CRE Investment Could Surge in Second-Half 2021

Investors are largely optimistic about a commercial real estate market rebound later this year, said Colliers International, Toronto.

Dealmaker: Walker & Dunlop Structures $175M for Mixed-Use, Multifamily

Walker & Dunlop, Bethesda, Md., structured $175.1 million in financing for a New Orleans adaptive-reuse development and three Utah multifamily properties.

Scott Roller: The Ebb and Flow of MSAs in Mortgage

Marketing Services Agreements somewhat remind me of when I’m in a long and slow traffic jam on the interstate, with everyone slowing down to decipher the mystery of what happened and see the first responders doing their thing… unsure of what I might see – tragedy or trivial.

Registration Now Open for MBA Spring Conference & Expo Apr. 20-22

The Mortgage Bankers Association has combined all of its signature spring conferences into a single Spring Conference & Expo, taking place via MBA LIVE from Apr. 20-22. Registration is now open.