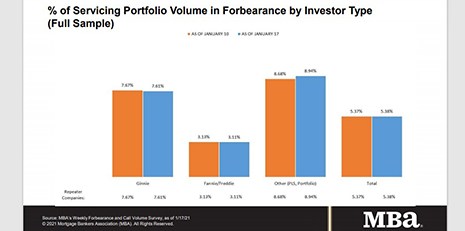

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased slightly to 5.38% of servicers’ portfolio volume as of Jan. 17 from 5.38% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

Category: News and Trends

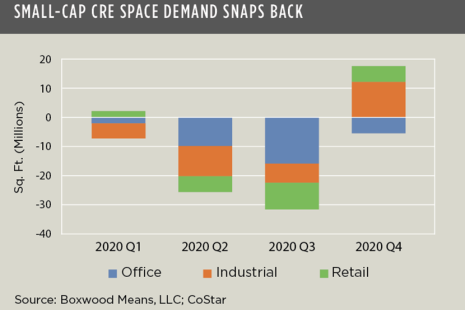

Leasing Demand Rally Encourages Small-Cap CRE Investors

A fourth-quarter rally in small-cap commercial real estate leasing demand improved the outlook for small-balance lenders and investors, reported Boxwood Means, Stamford, Conn.

Industry Briefs Jan. 26, 2021

SitusAMC Holdings Corp., New York, acquired Assimilate Solutions LLC, a provider of mortgage and title knowledge process outsourcing and information technology outsourcing platforms.

TransUnion: Percentage of Consumers with Financial Accommodations Remains Elevated

TransUnion, Chicago, said its latest Financial Services Monthly Industry Snapshot Report shows 2.87% of accounts in the auto, credit card, mortgage or unsecured personal loan industries remained in some form of financial hardship status at the end of December.

PennyMac Founder Stanford Kurland Passes Away

Stanford Kurland, who founded and served as Chairman of PennyMac Financial Services Inc., Westlake Village, Calif., following a multi-decade career at Countrywide Financial Corp., passed away on Jan. 25.

Dealmaker: Gantry Secures $32M For Industrial

Gantry, San Francisco, secured $31.6 million for industrial assets in Arizona and California.

Mark P. Dangelo: Establishing a Foundation for AI Growth and Profitability

The coming AI innovation disruptions do not represent more of the same. A model of maturity must be used to manage the definition, development, and implementation of all AI solutions as they form a cascading series of solutions, which must leverage humans—not just replace them.

MBA Advocacy Update, Jan. 25, 2021

On Wednesday, HUD issued a waiver allowing FHA to insure loans to borrowers with residency under the DACA program. And on Tuesday, FHFA issued an RFI on risks posed by climate change and natural disasters to Fannie Mae, Freddie Mac, the Federal Home Loan Banks and the broader housing finance system.

People in the News Jan. 26, 2021

Greystone, New York, hired Pranika Uppal Sinha as its Diversity, Equity and Inclusion Managing Director.

MBA Voices: Courageous Conversations with Women of Color Continues Feb. 2 with ‘Together We Rise’

The Mortgage Bankers Association’s popular three-part virtual series, Voices: Courageous Conversations with Women of Color, concludes on Tuesday, Feb. 2 with “Together We Rise.”