The Mortgage Bankers Association’s popular three-part virtual series, Voices: Courageous Conversations with Women of Color, concludes on Tuesday, Feb. 2 with “Together We Rise.”

Category: News and Trends

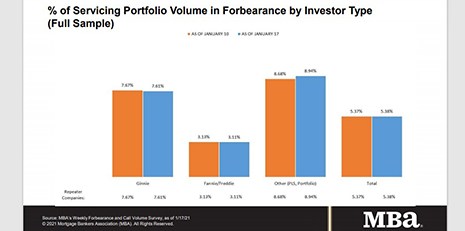

MBA: Share of Mortgage Loans in Forbearance Increases Slightly to 5.38%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased slightly to 5.38% of servicers’ portfolio volume as of Jan. 17 from 5.38% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

Matic Partners With MBA Opens Doors Foundation

Digital insurance agency Matic, Columbus, Ohio, and the MBA Opens Doors Foundation announced an ongoing partnership to help families with a critically ill or injured child make their mortgage or rent payment.

Call for Nominations: MBA NewsLink 2021 Tech All-Star Awards; Deadline Extended to Feb. 5

The Mortgage Bankers Association is accepting nominations for the MBA NewsLink 2020 Tech All-Star Awards. Nominations will be accepted through Friday, Feb. 5

Quote

“In a sign that borrowers are increasingly more sensitive to higher rates, large declines in government purchase applications and refinance applications pulled overall activity lower. The refinance index has now declined for two straight weeks, but is still 83 percent higher than last year. Purchase applications also decreased last week, but the impressive trend of year-over-year growth since the second half of 2020 has continued in early 2021.”

–Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting.

Mark P. Dangelo: Establishing a Foundation for AI Growth and Profitability

The coming AI innovation disruptions do not represent more of the same. A model of maturity must be used to manage the definition, development, and implementation of all AI solutions as they form a cascading series of solutions, which must leverage humans—not just replace them.

James Deitch, CMB: The Value of Data and Decision Intelligence in 2021 — and Onward

2020 fostered a new type of innovation for lenders to digitize their loan origination processes or improve workflow management and break down the barriers of the status quo. Sophisticated data management, now more than ever, is a non-negotiable means to maintain an edge over competitors.

Scott Roller: The Ebb and Flow of MSAs in Mortgage

Marketing Services Agreements somewhat remind me of when I’m in a long and slow traffic jam on the interstate, with everyone slowing down to decipher the mystery of what happened and see the first responders doing their thing… unsure of what I might see – tragedy or trivial.

Senate Confirms Yellen as Treasury Secretary

The Senate on Monday confirmed Janet Yellen as Treasury Secretary by an 84-15 vote.

Matic Partners With MBA Opens Doors Foundation

Digital insurance agency Matic, Columbus, Ohio, and the MBA Opens Doors Foundation announced an ongoing partnership to help families with a critically ill or injured child make their mortgage or rent payment.