The Mortgage Bankers Association is accepting nominations for the MBA NewsLink 2020 Tech All-Star Awards. Nominations will be accepted through Friday, Feb. 5

Category: News and Trends

Mark P. Dangelo: Establishing a Foundation for AI Growth and Profitability

The coming AI innovation disruptions do not represent more of the same. A model of maturity must be used to manage the definition, development, and implementation of all AI solutions as they form a cascading series of solutions, which must leverage humans—not just replace them.

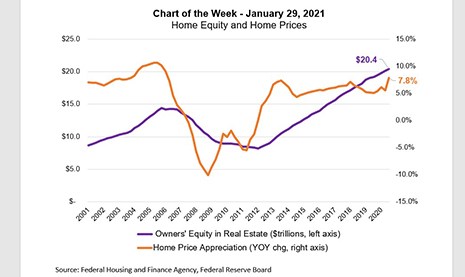

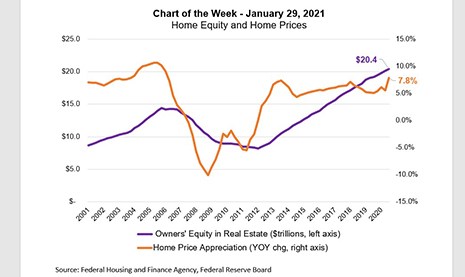

MBA Chart of the Week: Home Equity and Home Prices

Homeowners’ equity in housing was at a record high of $20.4 trillion in the third quarter. The steady upward trend since 2012 was spurred by accelerating home-price growth and low mortgage rates, which have helped many households build equity in their homes.

MBA Voices: Courageous Conversations with Women of Color TODAY with ‘Together We Rise’

The Mortgage Bankers Association’s popular three-part virtual series, Voices: Courageous Conversations with Women of Color, concludes on Tuesday, Feb. 2 with “Together We Rise.”

Seth Appleton: Five Key Themes from the MISMO Winter Summit and What We’re Doing to Address Them

As I reflect on my first MISMO event, the recent MISMO Winter Summit, I was struck by several key themes that emerged from the more than 220 industry participants who collaborated and shared their expertise across four days of coffee talks, panel discussions and workgroup meetings.

Mortgage Action Alliance Issues Call to Action on Senate Federal Tax Credit Bill

The Mortgage Bankers Association’s grassroots advocacy arm, the Mortgage Action Alliance, issued a Call to Action Friday in support of recently introduced legislation to create a federal tax credit to fuel development.

MBA Advocacy Update Feb. 1 2021

On Jan. 28, the Senate Banking Committee conducted a hearing on the nomination of Rep. Marcia Fudge (D-OH) to serve as the next HUD Secretary. Also last week, Senz. Ben Cardin (D-MD) and Rob Portman (R-OH) introduced S. 98, the Neighborhood Homes Investment Act, a bill that would create a new federal tax credit to fuel development in underserved rural and urban communities across the country.

MBA Chart of the Week: Home Equity and Home Prices

Homeowners’ equity in housing was at a record high of $20.4 trillion in the third quarter. The steady upward trend since 2012 was spurred by accelerating home-price growth and low mortgage rates, which have helped many households build equity in their homes.

December Pending Home Sales Fall for 4th Straight Month

Pending home sales fell in December for the fourth consecutive month, the National Association of Realtors reported Friday—but numbers can be deceiving.

Dealmaker: DB Capital Management Acquires 422-Unit Texas Apartment Portfolio

DB Capital Management, Los Angeles, acquired a three-property apartment portfolio in Austin, Texas, totaling 422 units.