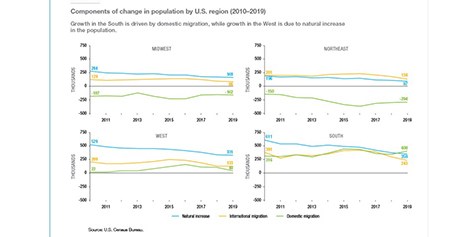

Freddie Mac, McLean, Va., reported the U.S. population in the South and West grew seven times faster than in the Northeast and Midwest between 2017 and 2019.

Category: News and Trends

Dealmaker: Eastern Mortgage Capital Closes $78M for Multifamily

Eastern Mortgage Capital, Burlington, Mass., closed $78.2 million in first mortgage loans secured by multifamily assets in three states.

Cap Rates for Single-Tenant Big Box Properties Compress

The Boulder Group, Wilmette, Ill., said single-tenant net lease big box sector cap rates compressed 25 basis points between late 2019 and late 2020 to 6.75 percent.

CRE & Lodging Landscapes Post-COVID: Conversation with JLL’s Ryan Severino, Michael Huth

MBA’s Andrew Foster recently spoke with Ryan Severino and Michael Huth of JLL on the outlook for commercial real estate and in particular, the hotel/lodging sector in a post-coronavirus environment.

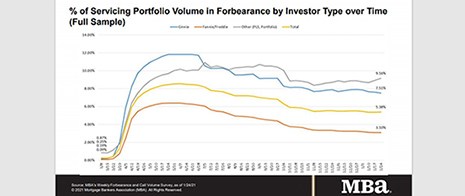

MBA: Share of Loans in Forbearance Unchanged at 5.38%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance remained unchanged at 5.38% of servicers’ portfolio volume as of January 24. MBA estimates 2.7 million homeowners are in forbearance plans.

People in the News Feb 2, 2021

Mortgage Bankers Association Chief Operating Officer Marcia Davies has been named at “10 Best COOs of 2020” by Industry Era magazine.

MBA Advocacy Update Feb. 2 2021

On Jan. 28, the Senate Banking Committee conducted a hearing on the nomination of Rep. Marcia Fudge (D-OH) to serve as the next HUD Secretary. Also last week, Senz. Ben Cardin (D-MD) and Rob Portman (R-OH) introduced S. 98, the Neighborhood Homes Investment Act, a bill that would create a new federal tax credit to fuel development in underserved rural and urban communities across the country.

Quote

“While new forbearance requests dropped slightly, the rate of exits from forbearance was at the slowest pace since MBA began tracking exit data last summer. Overall, the forbearance numbers have been little changed over the past few months. Homeowners still in forbearance are likely facing ongoing challenges with lost jobs, lost income and other impacts from the pandemic.”

–Mike Fratantoni, MBA Senior Vice President and Chief Economist.

A Conversation with Charmaine Brown, MBA Director of Diversity & Inclusion

The Mortgage Bankers Association recently hired mortgage industry veteran Charmaine Brown to fill its newly created position of Director of Diversity and Inclusion. MBA NewsLink spoke with Brown about her goals and objectives with MBA.

The CMBS Market During the Pandemic: Q&A with Dechert’s Richard Jones

MBA NewsLink interviewed Dechert Partner Richard Jones. He focuses his practice on sophisticated capital markets and mortgage finance transactions. He leads Dechert’s commercial mortgage-back securities team and serves as co-chair of the firm’s global finance group.