The Mortgage Bankers Association announced Jeffrey “Jeff” C. Taylor, Co-Founder and Managing Director at Mphasis Digital Risk LLC, Jacksonville, Fla., has been appointed chairman of the Mortgage Bankers Association Political Action Committee (MORPAC) for the 2021-2022 election cycle. Taylor served as Mortgage Action Alliance Chairman during the 2019-2020 election cycle.

Category: News and Trends

Steven Plaisance Appointed Chairman of Mortgage Action Alliance for 2021-2022

The Mortgage Bankers Association announced Steven Plaisance, President and CEO of the Mortgage Division with Arvest Bank, Fayetteville, Ark., has been appointed chairman of the Mortgage Action Alliance for the 2021-2022 election cycle.

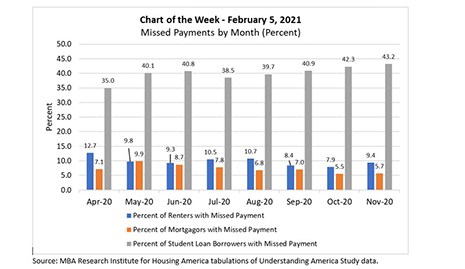

MBA Chart of the Week: Missed Payments By Month (Percent)

This week’s MBA Chart of the Week chart provides a preview of newly updated pandemic-related household financial insights that MBA’s Research Institute for Housing America released this morning, Feb. 8.

The Week Ahead—Feb. 8, 2021

Good morning! Welcome to another extraordinary week in Washington. Beginning Tuesday, Feb. 9, former President Donald Trump faces an historic second impeachment trial in the Senate.

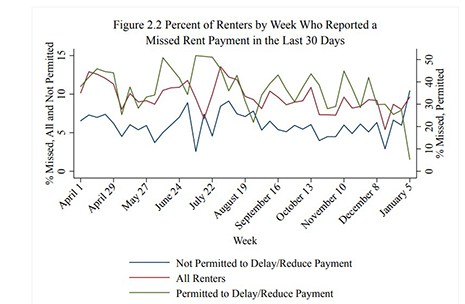

MBA RIHA Study Shows Progress, but 5 Million Renters, Homeowners Missed December Payments

Five million households did not make their rent or mortgage payments in December, and 2.3 million renters and 1.2 million mortgagors believe they are at risk of eviction or foreclosure or would be forced to move in the next 30 days, according to fourth-quarter research released today by the Mortgage Bankers Association’s Research Institute for Housing America.

Addressing America’s Affordability Crisis

Moody’s Analytics and the Urban Institute recently reported that more than 10 million U.S. renter households owe more than $5000 in back rent and fees as America’s affordability problem worsens during the pandemic. Analysts took on these and other issues in a lively session at the Mortgage Bankers Association’s CREF21 virtual convention.

Troubled Commercial Mortgage Loan Triage: A Special Servicer Roundtable

With the ebb and flow of 2020 market disruption in the rearview mirror and the vaccine rollout in full swing, MBA NewsLink checked in with a special servicer, a rating agency servicer analyst and Freddie Mac asset management chief to explore what is happening in commercial/multifamily markets, where different parts of the commercial real estate finance ecosystem are today and factors driving the outlook for agency and non-agency CMBS sectors.

Quote

“Gradual improvements in the labor market and economy helped more renters and homeowners make their housing payments at the end of 2020. However, the COVID-19 pandemic continues to cause financial stress for millions of Americans, and particularly for those who rent and have student loan debt.”

–Gary V. Engelhardt, Professor of Economics in the Maxwell School of Citizenship and Public Affairs at Syracuse University, on latest findings of a report from the MBA Research Institute for Housing America.

MBA Opens Doors Foundation Receives $1 Million Donation from Fairway Independent Mortgage Corp.

The MBA Opens Doors Foundation announced it received a $1 million gift from Fairway Independent Mortgage Corp. – the largest donation received in the foundation’s 10-year history.

Adam Batayeh: What Mortgage Lenders Can Learn from Tesla

Historically a cyclical business, mortgage lending has experienced substantial increases in volume, forcing lenders to throttle up their efforts, but those without an intelligent Loan Manufacturing (iLM) plan have been left with more challenges.