MBA is proud to recognize its Premier and Select Associate Members and to thank them for their continued support of MBA and the real estate finance industry.

Category: News and Trends

Nick Volpe: Managing Effects of Changing Regulations on Mortgage Servicing Operations

As loan servicers continue to battle operational challenges and brace themselves for continuously high volume, there are strategies they should consider to better navigate the changing landscape.

MISMO Implements Innovation Investment Fee

MISMO, the industry standards organization, has instituted a $0.75 per loan Innovation Investment Fee.

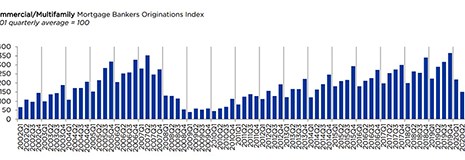

MBA: 4th Quarter Commercial/Multifamily Borrowing Falls 18 Percent

Commercial and multifamily mortgage loan originations fell by 18 percent in the fourth quarter from a year ago, but increased by 76 percent from the third quarter, according to the Mortgage Bankers Association’s Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations.

Mortgage Applications Decrease in MBA Weekly Survey

Rates rose to a three-month high last week, and mortgage applications dropped, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending February 5.

‘Murky’ Outlook for Office Sector

The U.S. office sector faces a “murky” future after a tumultuous 2020, said Yardi Matrix, Santa Barbara, Calif.

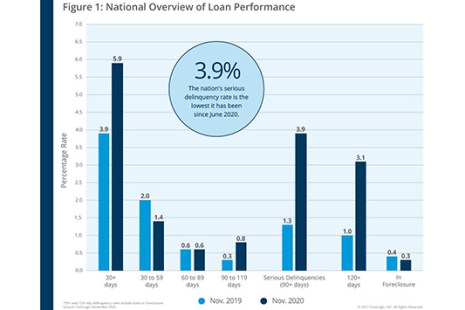

CoreLogic: November Mortgage Delinquency Rates at 11-Month Low

Ahead of this Thursday’s 4th Quarter National Delinquency Report from the Mortgage Bankers Association, CoreLogic, Irvine, Calif., said new November mortgage delinquencies fell below pre-pandemic levels and, while serious delinquencies fell to their lowest levels since June.

MBA: 2021 Commercial/Multifamily Mortgage Maturity Volumes to Increase 36%

The Mortgage Bankers Association says $222.5 billion of the $2.3 trillion (10 percent) in outstanding commercial and multifamily mortgages held by non-bank lenders and investors will mature in 2021, a 36 percent increase from the $163.2 billion that matured in 2020.

Dealmaker: JLL Arranges $84M for Office, Retail

JLL Capital Markets, Chicago, arranged $83.5 million in financing for office and retail properties in Virginia and Massachusetts.

MBA Forecast: 2021 Commercial/Multifamily Lending to Increase 11% to Nearly $500 Billion

The Mortgage Bankers Association expects commercial and multifamily mortgage bankers to close $486 billion in loans backed by income-producing properties in 2021, an 11 percent increase from 2020’s estimated $440 billion, according to its latest forecast.