“Analysis of ICE HPI data shows a broad-based cooling of home prices, with 90% percent of U.S. markets experiencing slower home price growth compared to three months ago.”

–Andy Walden, ICE

“Analysis of ICE HPI data shows a broad-based cooling of home prices, with 90% percent of U.S. markets experiencing slower home price growth compared to three months ago.”

–Andy Walden, ICE

Zillow, Seattle, found that Miami tops the list of best places to be a buyer this spring, and Buffalo, N.Y., is the best place to be a seller.

Power Hour Demos (formerly known as Demo Days) are designed to ensure MBA lender and servicer members have access to the latest technologies, services, and insights from our vendor members.

This week’s top legislative and policy news from the Mortgage Bankers Association.

Designed to carry you through the process of onboarding through career advancement and setting yourself apart, the Residential Certified Mortgage Servicer (RCMS) Certificate and Designation program is a comprehensive program comprised of three levels.

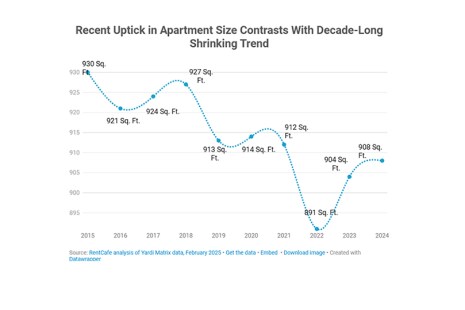

RentCafe, Santa Barbara, Calif., reported the average apartment size in the U.S. increased last year, to sit at 908 square feet.

Market volatility, both in equity and bond markets, increased sharply last week because of the serial surprises with respect to the direction of U.S. tariff policy.

Optimal Blue, Plano, Texas, released its March 2025 Market Advantage mortgage data report, finding a 24% increase in rate lock volume, attributed to early spring buyers entering the market and homeowners refinancing with recent lower rates.

Auction.com, Irvine, Calif., released its 2025 Buyer Insights Report, finding 64% of buyers of distressed properties at auction expect their purchases to increase in 2025, up from 60% in 2024 and 54% in 2023.

“Refinances made up a quarter of all lock activity for the first time in six months, and we saw a clear rise in non-conforming loan share as buyers looked for more flexible options and higher loan amounts.”

–Brennan O’Connell, Optimal Blue