As the anniversary of COVID significantly impacting the U.S. and commercial/multifamily property markets passes, challenging questions about property values remain top of mind.

Category: News and Trends

MBA: Share of Mortgage Loans in Forbearance Declines to 5.22%

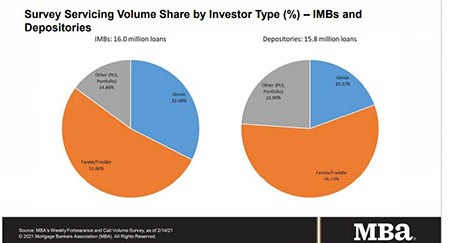

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 7 basis points to 5.22% of servicers’ portfolio volume as of Feb. 14 compared to 5.29% the prior week. MBA estimates 2.6 million homeowners remain in forbearance plans.

Sponsored Content from ServiceLink: How Servicers Can Prepare for Impending Defaults

By exploring third-party resources, services for alternate paths over foreclosure, and technology with built-in automation, servicers can ensure they are ready to help their borrowers when foreclosure and eviction moratoriums are lifted.

Mark Dangelo: Establishing a Foundation for AI Growth and Profitability—Part Two

The maturity of artificial intelligence is years away—yet the excitement and promise of returns and efficiencies have never been greater.

Paul Gigliotti: Benefits of Cross-Training and Hiring Outside the Industry

Paul Gigliotti is COO of Pinnacle Home Loans, Novato, Calif. He also serves as a board member of the California Mortgage Bankers Association.

Higher Liquidity Levels Improve Commercial Real Estate Lending Momentum

CBRE, Dallas, said higher levels of liquidity, tighter credit spreads and a modest loosening of underwriting standards contributed to a “sharp improvement” in commercial real estate lending momentum in late 2020.

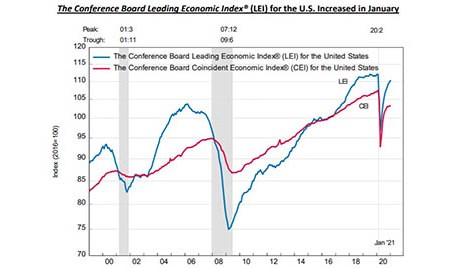

Leading Economic Indicators Up 3rd Straight Month

The Conference Board, New York, said its Leading Economic Index for the U.S. Increased in January, marking the third consecutive monthly improvement.

2021 Housing Market ‘Red Hot’

The past year has been like no other, housing-wise. Near-record-low interest rates, tight housing supplies and greater flexibility in where one lives have pushed a normally predictable housing cycle into uncharted territory, as three new housing reports show.

Dealmaker: CIT Provides $53M for Office, Multifamily

CIT Group, New York, provided $52.5 million in construction financing for a Nebraska office building and a Tennessee apartment community.

Priced to Perfection: CRE Values Inch Up

As the anniversary of COVID significantly impacting the U.S. and commercial/multifamily property markets passes, challenging questions about property values remain top of mind.