On Wednesday, the Consumer Financial Protection Bureau issued a notice of proposed rulemaking to delay mandatory compliance date of the General QM final rule. On Monday, the Federal Housing Finance Agency authorized Fannie Mae and Freddie Mac to release $1.09 billion in affordable housing allocations, more than double last year’s disbursement. And the Senate moved into floor debate and toward likely passage of its version of the COVID-19-related American Rescue Plan (H.R. 1319).

Category: News and Trends

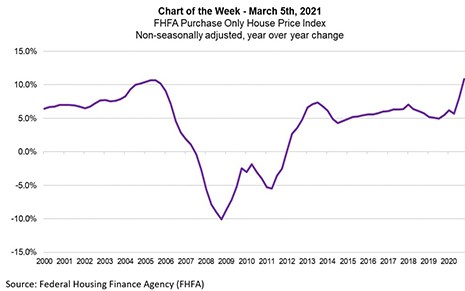

MBA Chart of the Week Mar. 5 2021: FHFA Purchase-Only Index

The rate of U.S. home-price appreciation continues to be driven higher by a combination of strong demand for housing and record-low housing inventory for sale. The Federal Housing Finance Agency’s most recent release showed the fourth quarter saw annual home-price growth of 10.9 percent –the strongest annual change on record. The previous high was an increase of 10.7 percent in third quarter 2005.

People in the News Mar. 9 2021

TIAA, New York, named Thasunda Brown Duckett to succeed Roger W. Ferguson Jr. as President and CEO.

Nicole Berg: 10 Skills You Need to Move from Processor to Underwriter

There is more to being an underwriter than learning guidelines. Based on my experience managing people moving from processor to underwriter, there are hard and soft skills you need before you can transition from Processor to Underwriter.

Joe Murin of JJAM Financial Services on the Future of the Housing Market—and the GSEs

Joe Murin is Chairman of JJAM Financial Services, Pittsburgh, Pa., which he founded in 2014. He previously served as Chairman of Chrysalis Holdings LLC and as CEO of ANC Holdings LP. Before that, he was Vice Chairman of The Collingwood Group and served as President of Ginnie Mae during the Obama Administration.

MBA: Customers Best Served By ‘Robust, Competitive Market’

So, you might have noticed some interesting recent developments in the mortgage broker world.

The Week Ahead—Mar. 8, 2021

The Mortgage Bankers Association has a busy week. MBA releases its weekly Forbearance and Call Volume Survey today (Mar. 8) at 4:00 p.m. ET.; On Tuesday, Mar. 9, MBA releases its monthly Mortgage Credit Availability Index. And on Wed. Mar. 10, MBA releases its Weekly Applications Survey.

(Switching Gears) Michael Franco: The Times, They Are A-Changin’—So You Should, Too

If the past year has taught us anything, it’s that Bob Dylan was right—the times they are a-changin’. From the pandemic to the overnight shift to remote work to the rollercoaster ride of the market, no one could have anticipated just how different 2020 turned out versus expectations. But there’s even more change in store in 2021, and businesses will have no choice but to adapt.

MBA Advocacy Update Mar. 8 2021

On Wednesday, the Consumer Financial Protection Bureau issued a notice of proposed rulemaking to delay mandatory compliance date of the General QM final rule. On Monday, the Federal Housing Finance Agency authorized Fannie Mae and Freddie Mac to release $1.09 billion in affordable housing allocations, more than double last year’s disbursement. And the Senate moved into floor debate and toward likely passage of its version of the COVID-19-related American Rescue Plan (H.R. 1319).

Industry Briefs Mar. 8, 2021

Ginnie Mae, Washington, D.C., said mortgage-backed securities issuance volume fell in February to $76.92 billion, down from the record $82.6 billion issued in January.